Search is not static – people don’t consume media in silos – and those consumers demand answers and content in an instant. Customers want information how they want it, wherever they are, in formats that delight — and they want it immediately.

This is especially true during the holiday season where SEO powers insights on consumer intent, behavior and trends across all digital channels.

If the analysts are right, the 2019 holiday shopping season will be one of the biggest in recent memory: 13% YoY growth for U.S. digital revenue ($136B sales) and 15% YoY growth for global digital revenue ($768B sales). And, while the season extends through the end of the year, a full 50% of all sales will be completed by December 6th – the last day of Cyber Week.

With so much shopping concentrated around the start of the holiday selling season – Black Friday through Cyber Week – there’s a lot of pressure on marketers to get the product, promotion and channel mix right ahead of time.

Most guidance on optimizing the search and digital marketing mix revolves – correctly – around the analysis and preparation you should be doing in advance of the shopping season, especially where SEO is concerned.

BrightEdge’s research found that SEO practitioners are using an average of six tools cobbled together and four-hours a day on research, reporting, and analysis. With half the day of an SEO practitioner spent on research, reporting, and analysis, it can be hard to find the time to actually make SEO changes and drive strategy over reactionary holiday periods.

Today, preparation and real-time marketing go hand-in-hand – especially when we think about voice, visual and vertical aspects of enterprise SEO.

Holiday seasons and real-time insights

Searchers are looking for the things you offer in any given moment, including throughout the holiday shopping season. If you know what people are looking for in the moment, you can capitalize on those trends in search and other marketing channels including on your website or in your dedicated ecommerce app, or in your digital advertising, email and social media campaigns.

Holidays are a period where things moving so fast (real-time demand for products) prices move, competition is higher than normal with new seasonal entrants, changes happen in real-time consumer habits (a trended new toy or gift, an influencer, a TV ad commercial driving online searches.

Consumers begin researching their holiday purchases well ahead of Black Friday, but on the day itself, searches ratchet up and stay elevated through Cyber Week. And shoppers are not done shopping when Cyber Weekends. This influx of new search data can expose opportunities that were not visible in the run-up to Black Friday.

During a compressed, high-volume shopping period like Black Friday or Cyber Monday, there will be predictable searches for the high-profile products and doorbuster deals where competition is high and margins are low, but there will also be demand for lower-profile, higher margin surprises.

To make the most of in-the-moment search insights, it’s important that you use a real-time information source to mirror the non-linear way consumers search that also enables you to follow fully the explicit and implicit paths indicated by those searches. Competition for these opportunities will generally be lower, but taken in aggregate, they can generate meaningful revenue.

Voice

With growing frequency, consumers are searching with their voices. At the end of 2018 there were 2.5 billion digital voice assistants in use by consumers. That figure is expected to grow to 8 billion devices by 2023. (source)

Consumers are using voice search more and more to shop with nearly 50% of people researching products by voice and 33% of people expected to use voice search to purchase a product at some point in 2019. (source)

But not all voice searches happen on one type of device and there are multiple avenues to consider.

(Source PWC)

In many ways the nature of voice search aligns closely with the practical application of real-time SEO. Voice searches tend to reflect in-the-moment queries. During the holidays, consumers will ask their voice assistants for help with product and shopping questions, like:

- What is a good gift for a 10-year-old boy?

- When is the last day for holiday shipping on Nike.com?

- Which restaurants are open on Christmas?

Conversational queries change so fast, that voice search becomes instantaneous. When strategizing for voice, it’s important to understand the conversational journey. What questions most frequently initiate a search? What are the three or four follow up questions someone is most likely going to ask? Because voice search advances so rapidly, real-time data is a necessity.

To do it, start with identifying all the top-of-funnel, awareness-generating question keywords and their search volume. Then, analyze the keyword landscape for which portion of your keywords contain questions, and finally, assess which portion of those searches you are winning, and which portion represent opportunity.

Visual – YouTube

Visual search in itself is whole topic and article so for ecommerce I will just focus on YouTube today.

Traditional search engines and YouTube are complementary when it comes to product research with 80% of consumers saying they “typically switch between online search and video when researching products to buy.”

YouTube also plays a role for more than half of consumers directly in the purchase stream: “More than 55% of shoppers say they used online video while actually shopping in a store.”

All of that search behavior harbors insight you cannot get from Google search data alone. For one, YouTube product research indicates an increased level of purchase readiness with 70% of people expressing a feeling of motivation after viewing a YouTube video.

Take advantage of YouTube search behavior data to expose in real-time the performance of your videos and your competitors’ videos for any search and identify which product, category, and brand video are receiving outsize interest as well as what searches are leading consumers to them.

Armed with these insights, you can react in the moment across your marketing channels to capture share of sales. Add to that shopping ads in YouTube and SEO and PPC synergy become a must.

(Source – Google)

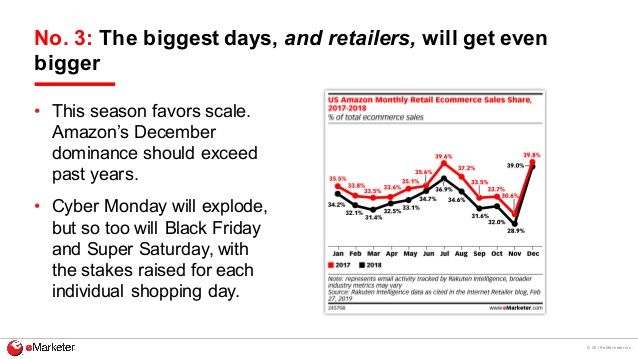

Vertical – Amazon

Nearly half of U.S. internet users start product searches on Amazon (eMarketer). As a marketers it is essential to know what are they searching for? What keywords are they using to search for it? Amazon may very well be the best source for insight into consumer purchase intent, so you cannot afford to ignore it.

For the products you sell on Amazon, especially if you sell hundreds or thousands of SKUs, it’s essential to track en masse the ranking of those products against your competition so that you can adapt in-platform while the selling opportunity is at its peak.

(Source – eMarketer)

Simultaneously, if there are products or product categories you don’t list on Amazon, you can still benefit from insights about searches within those categories.

Knowing this will help you understand where your biggest competitive threats lie so you can defend against them in your selling channels. It will also alert you to opportunities to meet heightened category demand via other channels.

Conclusion

Even with well-researched forecasts, there’s no way to know for sure how well a product category will perform for any sales period, but if you wait to measure that outcome and maximize sales, then real-time insights can take you all the way through to the January sales and more.

Jim Yu is the founder and CEO of leading enterprise SEO and content performance platform BrightEdge. He can be found on Twitter .

Related reading

Yext’s analysis of the year’s search behavior shows consumers look to go to the doctor’s office in January, the dealership in May, the mall in December, and more.

They might not be as “sexy” as ranking for short tail keywords but they convert better. A reality check about long tail keywords and why they’re key.

How developed is the voice search opportunity, what specific strategies do brands need to apply? A look at the current state of affairs and the way ahead.