Hey there, fellow financial enthusiasts!

Today, we’re diving into a topic that often finds itself at the center of heated debates and political discussions: the debt ceiling. You may have heard this term tossed around, but do you truly understand what it means and why it matters to your personal finances? Don’t fret! We’re here to unravel the mystery and shed light on how the debt ceiling can impact your financial future.

![]()

What is Debt Ceiling and Why it Matters

At its core, the debt ceiling is a legal limit on the amount of debt the government can accumulate to fund its operations and meet its financial obligations. Think of it as a financial cap that restricts the government’s borrowing capacity. Now, you might be wondering, “Why should I care about the government’s debt ceiling?” Well, my friend, the answer lies in the ripple effect it can have on various aspects of our economy and, ultimately, our personal finances.

When the debt ceiling is reached, it triggers a delicate dance of political negotiations and potential consequences. Failure to raise the debt ceiling could result in a government shutdown or default on its financial obligations. This scenario can have serious implications for the economy, causing instability in financial markets, increasing interest rates, and weakening the value of the currency. And guess what? All these factors can directly impact your wallet.

What Happens when Debt Ceiling is Raised (or Not)

When the government raises the debt ceiling, it allows itself to continue borrowing and meeting its financial obligations. This action provides stability and ensures the functioning of essential government services. However, it also means that the government’s debt burden continues to grow, and you might be wondering about the long-term consequences.

On the other hand, if the debt ceiling isn’t raised, it can lead to a government shutdown or, even worse, a default on its debt payments. This can create a domino effect, causing panic in financial markets, increasing borrowing costs, and potentially leading to a recession. These circumstances affect businesses, job security, and overall consumer confidence, directly impacting your financial well-being.

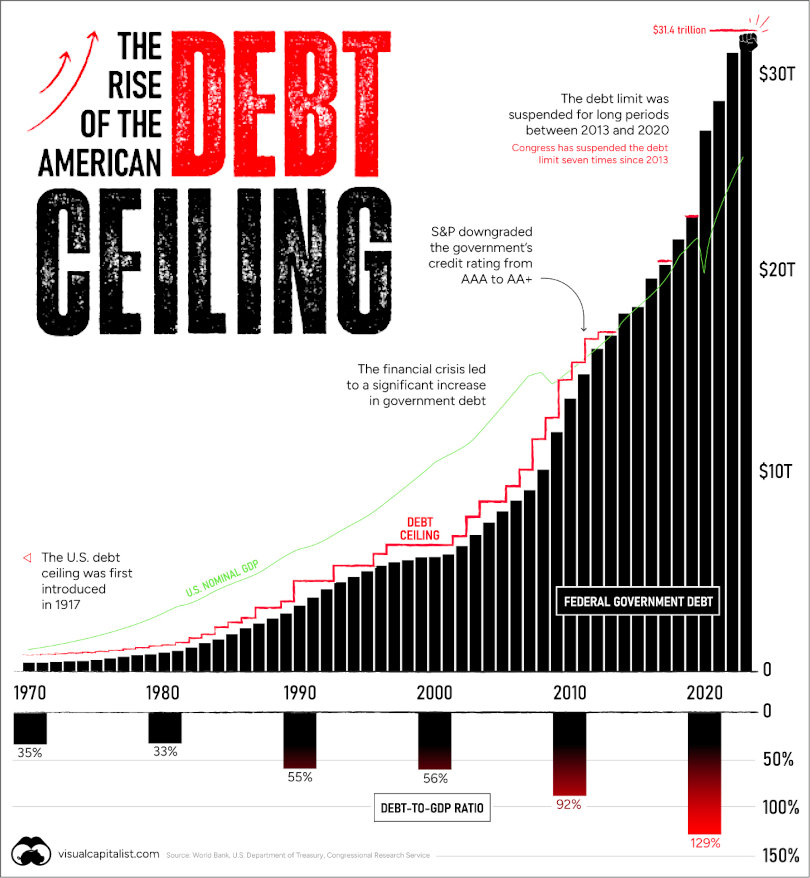

So, how high is the ceiling we’re talking about? To give you some ideas, here is a list of the last five debt ceiling raising in the U.S., along with the amount by which it was raised:

- September 28, 2017: Raised by $1.5 trillion to $20.3 trillion.

- August 1, 2019: Raised by $2 trillion to $22.3 trillion.

- December 21, 2020: Raised by $480 billion to $22.78 trillion.

- August 11, 2021: Raised by $3.5 trillion to $26.28 trillion.

- March 15, 2022: Raised by $480 billion to $30.78 trillion.

The approaching June 1, 2023 deadline for raising the federal debt limit has raised concerns as U.S. Treasury Secretary Janet Yellen warns of the government’s inability to pay all its bills. President Joe Biden, while deeming the Republicans’ offers unacceptable, remains open to spending cuts and tax adjustments for a potential agreement.

Failing to raise the debt ceiling could trigger financial market chaos and increased interest rates, underscoring the urgent need for action to avoid potential default and its far-reaching consequences.

How to Respond to the Government’s Decision about Debt Ceiling

As an individual, it’s essential to be prepared and proactive in response to potential government decisions regarding the debt ceiling. Here are a few steps you can take to protect your personal finances:

- Stay Informed: Keep an eye on news and updates related to the debt ceiling. Understand the potential implications and how they can affect your financial situation.

- Budget and Save: Establish a solid budget and build an emergency fund. Having a financial safety net can help you weather uncertain times and unexpected economic fluctuations.

- Diversify Your Investments: Consider diversifying your investment portfolio to spread risk. Explore different asset classes, such as stocks, bonds, real estate, and commodities, to protect yourself from potential market volatility.

- Minimize Debt: Keep your personal debt in check. High-interest debt can become burdensome during economic instability. Prioritize paying off debts and avoid taking on unnecessary financial obligations.

- Seek Professional Advice: Consult with a financial advisor to assess your personal situation and create a tailored plan. They can provide guidance on how to navigate uncertain financial times and make informed decisions.

![]()

Conclusion

Understanding the debt ceiling and its impact on personal finance is crucial for all of us. As citizens, it’s essential to stay informed, be prepared, and take necessary steps to safeguard our financial well-being. By staying proactive, budgeting wisely, and diversifying our investments, we can navigate the uncertain waters and protect our personal finances from the potential repercussions of the debt ceiling decisions.

Remember, your financial future is in your hands, and being knowledgeable about the factors that can influence it empowers you to make informed decisions.

While the debt ceiling may seem like a distant and complex issue, its ramifications can have a real impact on your daily life. By understanding its significance, you can better anticipate potential challenges and adapt your financial strategy accordingly.

So, the next time you hear discussions about the debt ceiling in the news or among friends, you won’t be left scratching your head. You’ll have a grasp of its implications and how it relates to your personal finances.

In a world where economic landscapes can shift rapidly, staying informed and prepared is key. Take control of your financial future by educating yourself about the debt ceiling and its far-reaching effects. By doing so, you’ll be equipped to navigate any potential storms that come your way and ensure the stability of your personal finances.

Remember, financial literacy is a lifelong journey, and each step you take toward understanding complex topics like the debt ceiling brings you closer to financial empowerment.

Stay curious, stay informed, and stay proactive in managing your personal finances. The debt ceiling may be a puzzle, but with the right knowledge and mindset, you can unlock the path to a secure financial future.

Here’s to your financial well-being and the pursuit of knowledge!