Change is the nature of business. Anyone who’s run their own business over the last couple of decades will have seen a huge shift in the way they operate. This doesn’t just include, say, retailers, it also includes accounting firms. If there ever was a period when accounting was about simple bookkeeping, those days are well and truly over.

Accounting today isn’t what it used to be. After all, since the days of the abacus, accounting has been growing in complexity and taking on new tasks. The accounting profession, thus, continues to evolve as new technologies emerge.

The advent of the cloud has had a transformative impact on accounting (and many other professions). Cloud-based phone systems, like those offered by RingCentral, give accountants the freedom and flexibility to work from anywhere.

Meanwhile, other technologies, such as the Internet of Things (IoT) and artificial intelligence—a term sometimes used interchangeably with machine learning, a distinction we’ll elaborate on—promise to further revolutionize accounting in the years ahead.

The rise of automation aided by AI, which has rapidly gathered pace, has left many wondering what the future of accounting might look like, and, indeed, whether it has a future at all. There is a tendency to assume that the forward march of technology will inevitably render unfortunate accountants obsolete.

Fortunately for everyone in the accountancy field, it’s nowhere near that simple. In fact, automation promises to make the working lives of accountants easier, rather than making them redundant.

We’re going to delve deeper into the future of accounting to see what it might hold and how tech affects it. We’ll assess the state of play with regard to technology and how accounting firms have embraced it in recent years.

Then, we’ll look at how individual technologies are changing the face of the profession. Finally, we’ll also look to bust some of the prevailing myths around automation and its implications for accounting.

Click here to read ahead:

Technology and the future of accounting

One of the major trends in accounting over recent years is that tax preparation software (such as SimpleTax and TurboTax) allows businesses to file their own tax returns easily, without the help of an accountant. Needless to say, this has substantial implications for accountants.

But even this doesn’t mean that accountants are inevitably headed for the history books. They will, however, have to focus more on building strong working relationships with clients, providing the kind of service with which mere self-service software simply cannot compete.

Ironically, it’s another area of technology which may ride to the rescue. As we’ve noted, the introduction of cloud computing has had particularly far-reaching effects for accounting firms and other businesses. The arrival of cloud technology has considerably sped things up, allowing for the instantaneous, real-time updating of important information.

The ultimate objective of introducing cloud computing is, quite simply, to improve the client experience. The cloud is helping to make life more convenient for them, enabling them to run their affairs in a more efficient way. This is the real ‘end game’ of using cloud technology.

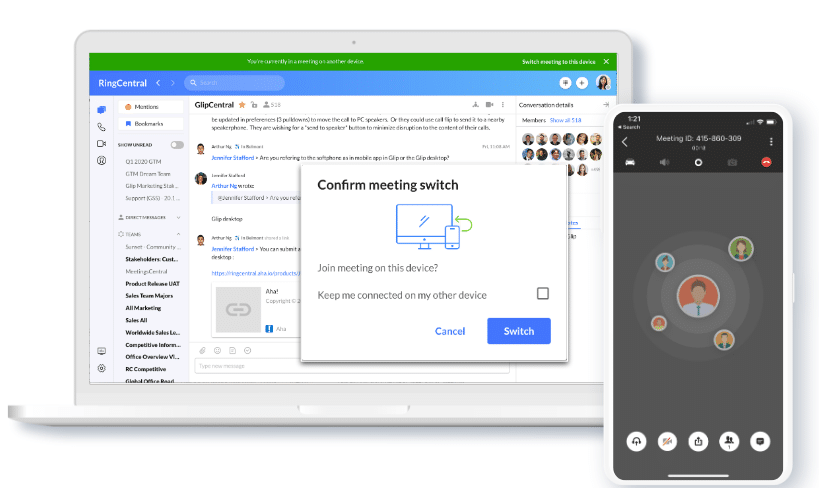

Communication is another area where cloud-based software has made a profound difference. For instance, the RingCentral app’s video conferencing feature is a great way of communicating with clients, enabling you to continue to provide a personal touch, while its team messaging feature helps you stay in close contact with your colleagues, facilitating more effective collaboration. The key, however, is that it brings all those business communication channels together in one app:

Having these types of smart software solutions means that many of the more time and labor-intensive aspects of accounting have already been automated away by technology—without somehow consigning the entire profession to the history books. In more traditional industries like accounting, it’s particularly striking just how extensive the change has been.

This process is set to continue, too. Tasks in the process of being automated, if they haven’t been already, include the following:

- Payroll

- Tax preparation

- Cash flow

- Audits

- Payroll

Data entry and data analytics have already been largely automated for a number of years, too. Accounting software, such as Xero and Intuit QuickBooks, has already taken on many of the everyday bookkeeping tasks, leaving accountants (and people running small businesses) with more spare time to devote to more productive uses.

The emerging generation of new technologies, meanwhile, promises to go even further.

Robots, AI, machine learning, and accounting

We’ve already touched on the importance of the cloud and the way it’s changed the face of accounting. This is proving to be just the start, however, of a wider technological transformation.

Although automation is often presented as a threat to jobs, it is also helping to liberate firms from the burden of busywork—tasks that, while necessary, serve to clog up our daily working routines. Solutions like RingCentral’s auto attendant, a virtual receptionist tool, are among those helping to free up human resources for more productive uses elsewhere.

In particular, artificial intelligence (AI)—and specifically machine learning—is promising to have far-reaching implications for accounting professionals and their everyday tasks. It has the potential to affect everything from auditing to forecasting.

Perhaps you’ve seen these terms thrown around before, without any real explanation of what they mean. The most important thing to remember about AI and machine learning is that the technologies that make use of them have the capacity to learn autonomously.

This means that in the near future, self-learning systems could effectively take responsibility for a lot of the more repetitive and menial jobs, so humans can concentrate more on analytical tasks.

As we’ve mentioned, you often see the terms “AI” and “machine learning” used side-by-side with one another. Machine learning is a branch of AI. If AI is the underlying logic itself, the methods that are used to make technology intelligent, then machine learning is concerned with the practical implementation of those methods and how they’re put into concrete effect.

It goes without saying that all this could bring about major changes in the way we deliver accounting services. But machine learning is not the only technology that’s set to shake up the accounting profession.

There’s also blockchain technology, which is more associated with cryptocurrency (digital currencies such as Bitcoin), that also looks set to have implications for accounting. This is because it allows users to access ledgers in real time, leading accountants to sit up and take notice. Major accounting firms including KPMG have already started to adopt the technology.

Is accounting a dying career?

With all these new developments in the technological sphere, you could be forgiven for thinking that human accountants don’t have much of a future to look forward to.

A lot of people have speculated that they may indeed be condemned to the ash heap of history as new innovations put them out of work. However, there are other indications that suggest verdicts such as these are likely to be premature.

According to a study from the Bureau of Labor Statistics, accounting jobs are set for robust growth over the next few years. The report predicted that there would be a 10 percent increase in employment in accounting and auditing between 2016 and 2026.

This suggests, then, that the rapid advance of technologies is not making accountants redundant. In fact, it may even be the case that these new innovations are helping to create more jobs in the profession rather than destroying existing ones.

Businesses have sought advice from accountants on how to integrate new technologies (including financial systems) into their own operations, leading the latter to take on a new role providing advisory services in this area.

Accountants have also taken on new responsibilities in helping clients to adapt to changing regulatory requirements, which have themselves changed rapidly as a result of technology. In fact, technologies are helping them to deliver higher standards of service all round.

Like a lot of other professions, accountants are also adapting to the new norm of remote work. Take Chicago-based accounting firm, Mowery & Schoenfeld, for example. They recognized not only that remote work was the future of work, but also that client experience would still need to be top-notch, no matter where their staff was located. So, they adopted a cloud-based phone system—that allowed them to do way more than just make phone calls:

This way, not only could they provide more flexibility for their own team and allow them to flip calls between their laptops and phones while on the road…

They were also able to switch a call from voice-only to a video conference, just in case a client wanted to have a face-to-face conversation:

The company has found that RingCentral has given it greater freedom to address the needs of clients while boosting productivity. As the RingCentral app also comes equipped with video conferencing capability, it has also used the app for internal meetings, client meetings, and video-based training.

In ways such as these, technology is changing the face of accounting.

What all this tells us, then, is that the much-hyped obsolescence of the humble accountant has been drastically overstated. We can certainly expect, however, that technology will continue to spur great changes to the way accountants work. What’s important is that we’re able to anticipate and appreciate the likely ramifications this will have.

The future role of accountants

So, what will the future look like for accountants? People who’ve devoted years of their life to becoming a certified public accountant (CPA) or chief financial officer (CFO) will no doubt be somewhat nervous about the potential implications.

It’s understandable that many fear all their hard work to gain entry into respected bodies like the AICPA could turn out to be wasted effort.

After all, CPA exams consist of four grueling four-hour sections:

- Auditing and Attestation (AUD)

- Business Environment and Concepts (BEC)

- Financial Accounting and Reporting (FAR)

- Regulation

To become a CPA, candidates have to pass all four of these sections within the space of 18 months, obtaining a score of at least 75 for each part. Obtaining professional accreditation is a serious undertaking. Few people would want to put themselves to all that effort only to find that their chosen profession risks becoming obsolete. Thankfully, that isn’t the case with accounting.

Today, there’s more data and information at our disposal than ever before, and someone needs to help businesses understand it. The shift to remote work, accelerated by the recent pandemic, has reinforced the importance of this data, and there’s a huge variety of metrics that we can use to make better business decisions.

The job of modern accountants is to help businesses make sense of that data, not just simply running the books and ensuring compliance.

Tools such as RingCentral are helping to make the shift to remote working as smooth and straightforward as possible, enabling accountants working from home to stay in touch with one another and with clients.

We can’t predict exactly how accounting will evolve over the coming years. But the speed of that evolution is clearly accelerating. A willingness to evolve along with technology will be crucial for anyone who wants to succeed in the profession over the long term.

Clients will continue to need human accountants for a long time to come. Those accountants who resist inevitable change, however, risk being left behind.

Looking For Startup Consultants ?

Call Pursho @ 0731-6725516

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads