One of the core factors every investor will face is how they can balance their investment portfolio to ensure they receive the greatest amount of returns possible while ensuring the safety of their investment.

In today’s financial market, the number of investment options available to the average investor has grown exponentially. However, while the scale of available and accessible investment options is a step forward as we further develop financially, the scale of availability provides investors with several questions of what is the right choice for them.

While the answer to this question is dependent on a number of personal factors including your investment experience, how old you are, your investment philosophy and most importantly, how much you can afford.

There are several universal methods you can adopt to ensure your portfolio is balanced. Before we explore some of these, we must understand why we need to balance our investment portfolio.

Why should you have a balanced investment portfolio?

For those who are unaware, a balanced investment portfolio is a mixture of assets, all of which perform differently at varying stages of the economic cycle.

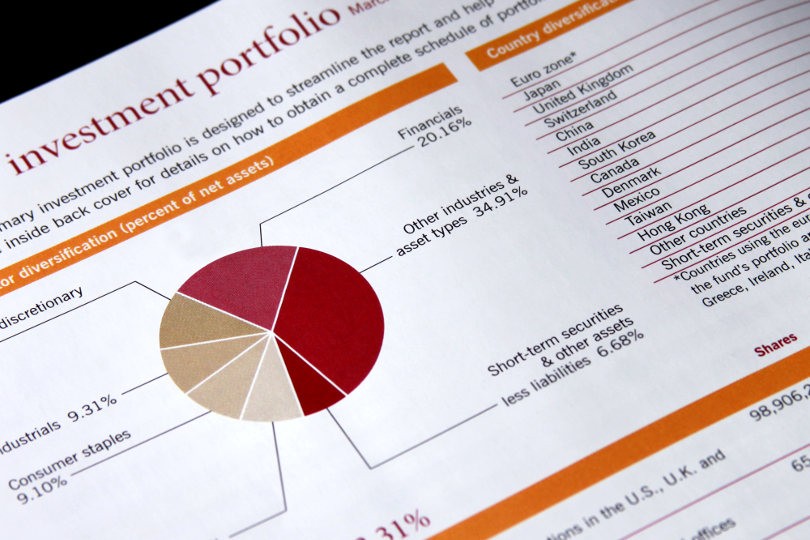

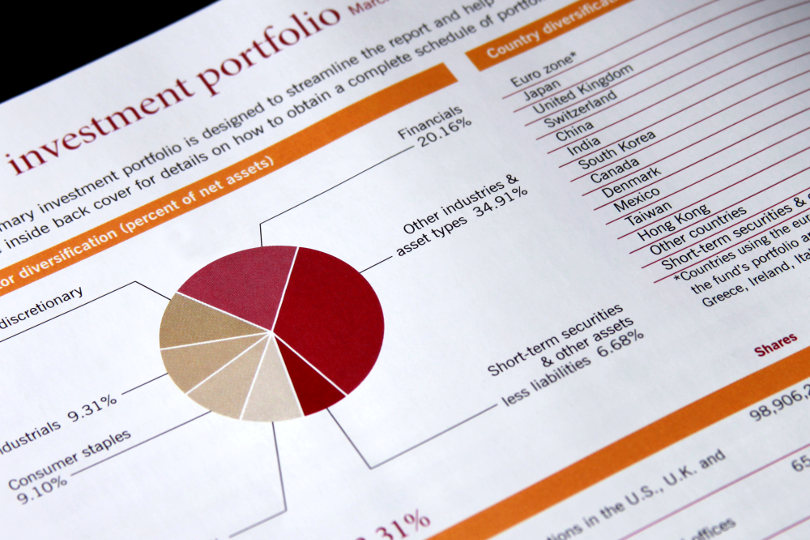

Aside from solely focussing on shares, a balanced investment portfolio is defined by the collection of independent investment options, such as fixed-rate income assets, property-development investment, ISA’s and international investments,

There are a number of reasons why one may look to balance or diversify their investment portfolio. One of the most prominent reasons is to do with the notion of risk. While every form of investment, even the most reliable, has some level of risk associated with it, some forms of investment are riskier than others. The idea of a diverse investment portfolio is to spread the level of risk across a wide range of investment options to ensure you are protected if one asset type negatively performs.

How can you balance your investment portfolio?

How you go about balancing your investment portfolio is dependent on your current investment portfolio and how much you can afford. While this is the case, there are a number of universal methods that can be utilised.

Diversification

The number one way to balance your investment portfolio is through simple diversification of the assets you include in your investment portfolio. One of the critical elements in any healthy investment portfolio is the inclusion of a range of asset classes. But what does this mean?

As mentioned, this means an investor will choose to invest to spread their investment across a range of asset classes, including fixed-rate investments such as bonds, property investments or currency and equities. It is vital that when you diversify your investment portfolio, you choose a range of assets that are disassociated from each other. This will ensure that you should continue to see returns even if one asset class is underperforming.

For those who are unsure of how to diversify an investment portfolio, investors can look to utilise investment funds who naturally spread investment across a number of assets.

Returns

While this will naturally come when you diversify your investment portfolio, investors can balance their investment portfolio through the form of returns they would look like to see. But what does this mean?

The returns an investor will seek will depend on what their overall goal or investment strategy is. Investors can see a range of return or payment methods across a single investment portfolio, including, income-like payments, interest payments, or capital gains.

For those who are unsure of how you can balance your investment portfolio, here are the most common forms an investor can expect:

1. Interest payments

One of the more secure forms of returns an investor can pursue are interest payments from simple investments as continued contributions to saving accounts or more complex investment types as fixed-rate bond investments. With these types of investments, investors will know exactly how much money you can receive from your investment.

2. Dividends

Some stocks pay growth dividends, which in short gives the investor a share of what the company makes. Acting in a similar vein to a ‘regular income’, investors can expect to see payments in defined dates during the year. The amount you can receive from a dividend depends on how well the company did that year, and the amount of stock you own.

It is important to note dividend payments are usually used by companies as a goodwill gesture in an attempt to increase investment year on year from their shareholders.

3. Capital gain

Capital gain from an investment is often available from one form of action. Capital gains will arise when an investor sells their stake in a company, bond, or their position in a fund, for more than they paid. If your investment portfolio is based solely around this form of return, you will naturally see a higher rate of risk.

As mentioned, while the returns an investor will seek is dependent on their goal or investment strategy, a healthy portfolio will look to see returns across these three formats. Although this will more than likely come naturally if you have a diversified range of assets, investors should be aware of where their returns will come from if the market is performing poorly.