A new year means it’s time to look ahead at financial services trends on the rise. Global inflation was the dominant story in the financial sector throughout 2022. In 2023, businesses and consumers continue to adapt to higher interest rates, which Central Banks deploy to combat inflation.

Investors and lenders are operating with a greater sense of caution and using advanced technology to reduce risk, optimize expenses, and boost productivity, without sacrificing the customer and employee experience. These factors play a pivotal role in financial services trends for 2023.

Let’s take a closer look at six trends on the horizon in financial services:

- Financial institutions embrace a more conservative strategy

- More focus on innovation and automation

- AI for financial services goes mainstream

- Increased focus on compliance and consistent risk management

- Optimization of hybrid work for productivity and security

- Simplification and modernization of core applications via cloud migration

Free eBook

Free eBook

“Ensuring compliant communications in financial services” (American Banker)

1. Financial institutions embrace a more conservative strategy

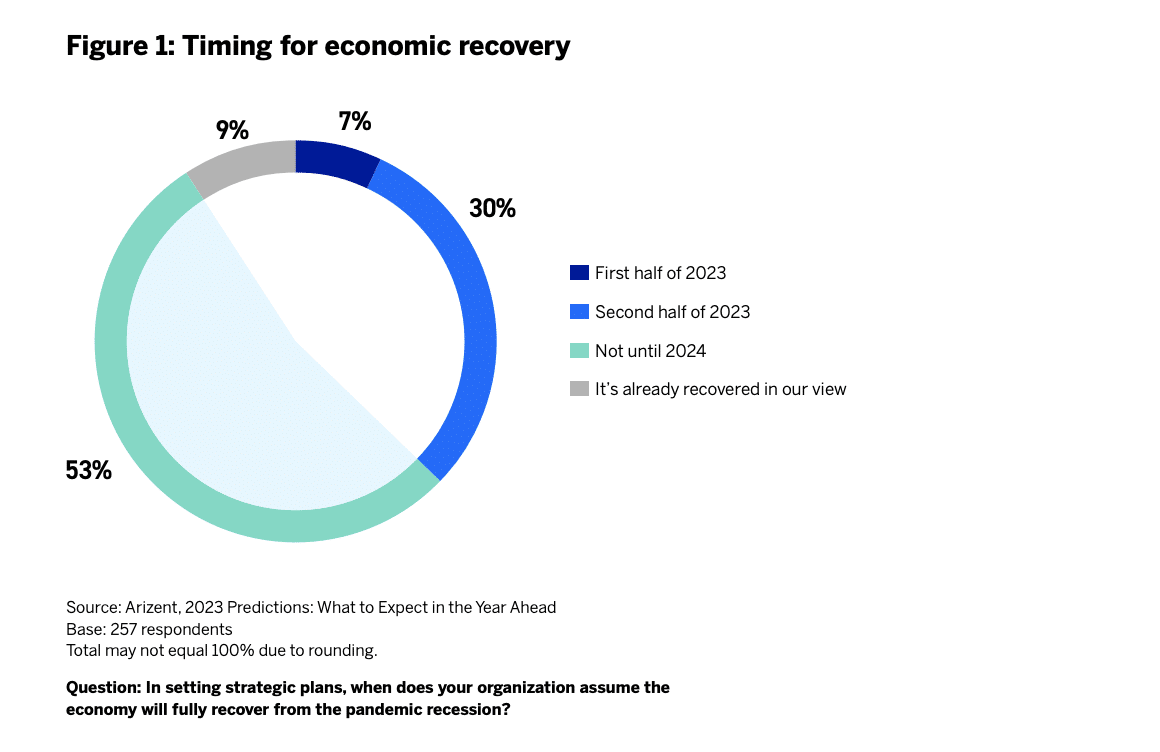

A majority of financial institutions don’t anticipate economic recovery until sometime in 2024. That’s the message from 54 percent of respondents in the 2023 American Banker report.1 Among the more optimistic views, 9 percent indicated recovery has already occurred, 7 percent expect it to occur in the first half of 2023, and 30 percent forecast recovery in late 2023.

At best, there is widespread uncertainty among financial institutions about the state of the economy, which typically leads to more risk-averse strategies. Lenders are reducing the number of loans they offer and focusing on the best reward-to-risk opportunities. Wells Fargo recently announced that it was dramatically shrinking its mortgage business, for instance as the rapid rise in interest rates has significantly curtailed demand for refinancing and new mortgage loans.2

2. More focus on innovation and automation

On the whole, banks have reduced budgets and are focused on cost optimization. However, technology and innovation is one category in which firms continue to invest.

Specifically, solutions that facilitate better collaboration are top of mind for financial institutions. Collaborative solutions support innovation efforts and help organizations get new products to market faster, which is a key differentiator in an uncertain economy.

Interest in innovation aligns with the overall efforts to make the most of assets, people, and capital. Banks have allocated budgets to technology that supports a more remote workforce in the last few years. In 2023, solutions that improve communications, the customer experience, and automation are popular choices.

3. AI for financial services goes mainstream

Practical artificial intelligence (AI) is now mainstream for large firms deep within their digital journey. Smaller firms have begun to experiment with AI as well. Accenture recently projected that by 2035, artificial intelligence capabilities will lead to a 35 percent boost in productivity over the baseline in developed countries.

Examples of AI application in financial services include:

- Right channeling: Suggesting the best channel to solve each customer’s needs. Doing so optimizes the customer experience and reduces service process inefficiencies.

- Personalization across all touchpoints: Improved empathy, especially in collections and other more sensitive activities. Personalization will become a more important determining factor when customers choose financial solutions.

- Increased knowledge of employee productivity: An interconnected ecosystem for knowledge workers and call center agents. Shared AI-driven data fuels more accurate forecasts and decisions.

Firms that leverage artificial intelligence in these ways will achieve major competitive advantages, such as better experiences for both call center agents and customers, higher customer satisfaction (CSAT) scores, improved operational efficiencies, and better customer and employee retention.

Customer engagement strategies for financial services

4. Increased focus on compliance and consistent risk management

Over the past few years, several financial institutions have been hit with large fines for failing to adhere to key regulatory requirements. Heightened regulatory and reporting requirements put more pressure on banks and other financial institutions to achieve compliance and manage risks across all touchpoints.

Additionally, with a more remote, digitally connected workforce, financial services providers have a greater volume of sensitive communication and data moving between locations and tools. The problem with ensuring compliance stems from the proliferation of digital channels coupled with the customer’s expectation of being able to use the communication tools and apps they want and are most comfortable using. But companies don’t need to give up ease and convenience for security and compliance.

Meeting these standards with the right solutions is the only way firms can safely provide their employees with access to a full suite of tools and features while also mitigating the potential risks. Safety protocols like multi-factor authentication and end-to-end encryption, along with established practices for storing data, documents, and interactions are critical.

5. Optimization of hybrid work for productivity and security

Optimized team-level interactions for hybrid workers drives satisfaction and productivity. The impact of remote and hybrid work teams has not faded since the onset of the pandemic. Instead, banks have invested even more resources to support hybrid work units while continuing to balance in-person and remote work to the needs of the business. This means a one-size-fits-all approach to work doesn’t fit, and financial services firms are looking for solutions that enable different approaches not only to the firm as a whole, but even for individual divisions or teams.

Hybrid structures offer more flexibility to employees, which allows banks to attract a larger pool of talented employees. To improve productivity and satisfaction, firms must continue to invest in reliable and secure communications systems and solutions.

Digital communications systems, particularly those with strong integration with other business applications, are a key priority. With a more remote workforce and a more digital-centric customer base, the ability to communicate efficiently and safely across all channels is vital.

RingCentral expands end-to-end encryption to phone and messaging

6. Simplification and modernization of core applications via cloud migration

Cloud migration is essential for companies to leverage practical AI, achieve compliance and risk management, and optimize unit-level hybrid work. A cloud-based system supports integration of common applications and business processes, which reduces silos and time-consuming manual processes.

A modern cloud infrastructure contains the most advanced security protocols. The foundation provided by a unified communications solution contributes to optimized internal and external communication as well as simplified record-keeping and retrieval.

RingCentral helps financial services organizations stay on-trend

The need to balance caution with competitive growth is central to the trends shaping financial services in 2023. Financial institutions remain uncertain about the near-term financial climate and are concentrating capital on high-reward, low-risk investment and loan opportunities. They also want to simplify and modernize core applications via cloud technologies.

In an effort to build leaner and more efficient systems, financial institutions are investing in communications and automation-centered technologies. RingCentral’s unified communications and contact center solutions offer a comprehensive platform to optimize internal and external communications and collaboration. As an essential part of the digital transformation journey of the financial services industry, RingCentral contributes to improved workplaces and a better customer experience. See how RingCentral works today!

1“Exclusive report: Brace for the short, prepare for the long: Financial institutions calibrate priorities for 2023.” American Banker.

2“Wells Fargo to shrink mortgage business, exit correspondent lending.” Reuters.

Originally published Feb 09, 2023

Looking For Startup Consultants ?

Call Pursho @ 0731-6725516

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads