Invoicing directly impacts your cash flow, and billing issues might prevent you from effectively managing your business and generating revenue.

As a small or medium-sized business owner, you’ll benefit from being extra careful about how you process your electronic invoices in order to cut down the days sales outstanding (DSO).

In this article, we’ll discuss all major issues and threats that arise in connection with your invoicing practices, and offer you effective solutions — like using the proper invoicing software — that you implement right now.

Invoice and invoice issue definitions

Let’s start with the definitions of terms we’re using frequently today.

- An invoice can be defined as a record of an exchange between two parties. It includes details of the transaction and a time stamp.

- An invoice issuing is the first thing a business owner will do when they want to collect payments from clients. They send either electronic or paper invoices to prove that they are owed money for goods or services provided.

When paying for something on time, the invoice usually includes details regarding when payments must be made and which type of transaction they represent (e.g., cash, check, etc.).

There are many different forms of invoices in existence, which are currently considered legitimate in different countries, including paper bills, electronic records, or receipts.

So, the main value of the invoice is to prove that one party is obliged to pay the second party an amount of money within the terms detailed in the document. Accountants also use invoices for bookkeeping and taxation purposes.

The basic things that should be included in an invoice

Here are some things that act as a basis for each properly-issued invoice:

- The word invoice itself. For all parties involved, the best way to ensure that there is an invoice is to write it openly.

- All the necessary data about the selling party.

- Payment amount, type, taxes included, due date, etc.

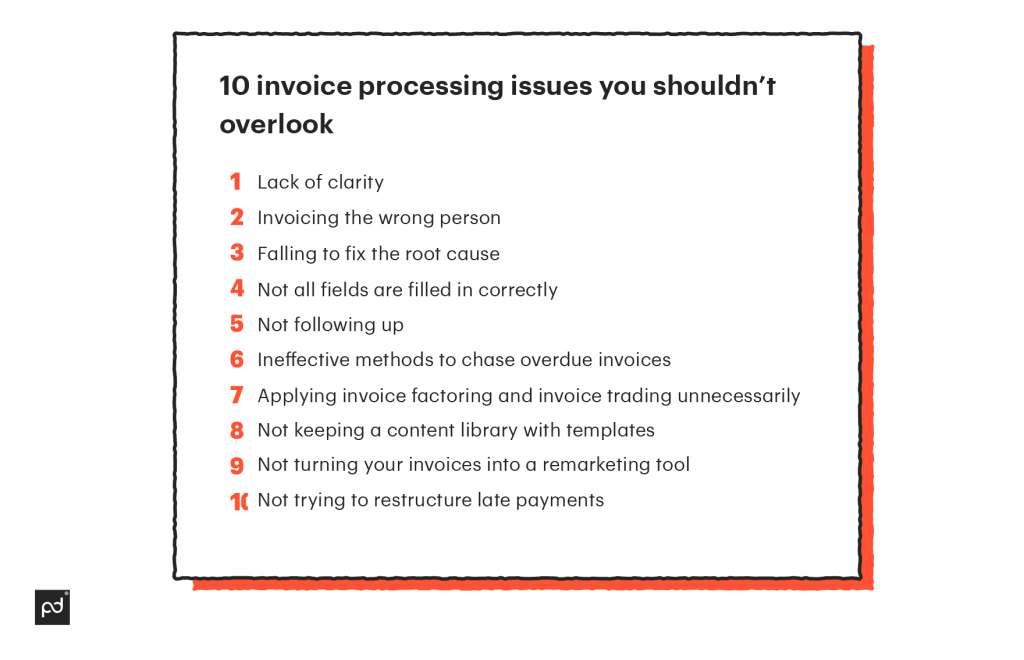

10 invoice processing issues you shouldn’t overlook

1. Lack of clarity

You might be sure that you are on the same page with the customer when you invoice them.

However, your partners might have a hard time figuring out how you’ve arrived at the calculations and where the itemization comes from.

Unclear invoices require your recipients to circle back to your team and engage in lengthy discussions to shed light on the lines in your invoice and realign them again.

Fix this invoicing issue by always tying your invoices to purchase orders, job quotes, or other supporting documents.

Referencing the previously agreed-upon documents will accelerate the acceptance time and help you push forward with your invoices.

2. Invoicing the wrong person

As a small business, you sometimes interact with much bigger teams.

These larger businesses, especially enterprises, have multiple divisions and personnel charged with handling invoices for specific types of services or segments.

Should you invoice the wrong person, your bill risks finding itself in the “To-be-determined (TBD) pile,” where it will remain until you start ringing the alarm bells about the invoicing issues and late payments you see in your accounts payable (AP) records.

Never hesitate to confirm — and, whenever you deem it necessary, reconfirm with the employee responsible for your invoicing.

Carefully store all comments and “side notes” about the delineations between the financial staff with your customers.

3. Falling to fix the root cause

Small business owners or early-stage employees often find themselves feeling urged to apply one-off solutions due to the lack of time or resources at their disposal.

In many cases, a menagerie of problems grows out of juggling multiple software in sales and lead generation, digital marketing, hourly billing, and struggling with issues in invoicing and accounting.

Consider moving to a more effective integration between more user-friendly SaaS — for example, choosing Pipedrive for all CRM needs and PandaDoc for seamless invoice population, generation, and follow-up management.

4. Not all fields are filled in correctly

Filling out recurring invoices and multiple bills with similar services or products can get tedious.

Your staff might make inadvertent mistakes and overlook important details. Human errors can wreak havoc in your accounts payable if not executed diligently.

Migrating to an automated system will help your team deal with the boring stuff.

For example, PandaDoc allows multi-user teams to collaborate and automatically use variables to populate the standard fields.

Eliminating the labor that manual effort requires frees your staff to take on more creative and impactful tasks.

5. Not following up

Fast-moving and Agile teams aim to focus on their core activities.

Following up on invoices and reminding customers that the due date is close takes up valuable resources.

Just as with other facets of the invoicing process, your automated system can be set up for furnishing reminders after a certain time has passed.

In combination with the actionable metrics we’ve talked about above, this empowers your team to better manage your AP and reduce the total count of overdue invoices.

6. Ineffective methods to chase overdue invoices

No matter how diligent you are in picking your business partners, some of them might look to postpone the payment process or shirk the responsibility overall.

Growing businesses might decide to forego the excessive efforts of chasing non-payers and prefer to focus on generating more sales instead.

This might gradually eat into your profits and increase the “hidden overhead” formed by a constantly growing stack of debt you have to write off.

An easy way to mitigate this eventuality is to ensure that all of your invoices are signed by both parties.

PandaDoc helps your team easily create fully signable POs, job quotes, and invoices. Just drag and drop the signature field to create a sleek and legally binding document.

Those customers, once they have signed the invoice, are now acting in a much more reliable manner. Should they get late on their bills, the signed invoice will form an important piece of the paper trail.

With it, you’ll be prepared to consider various routes to solve late payment and post-invoicing issues:

- First, you can better engage with your opposing parties via effective negotiations, backing up any claims with a suite of fully signed documents, including the contract and invoice.

- Second, you’ll have an easier time talking to debt collectors or other debt enforcement partners.

- Third, as a last-resource measure, consider hiring a lawyer and filing a lawsuit. Having your customer’s signature on all of the relevant documents helps create a sturdy foundation for your legal claim.

7. Applying invoice factoring and invoice trading unnecessarily

Each small business launched before yesterday has a few or more unpaid invoices.

It is especially common if your small business collaborates with larger B2B players.

As a result, you’ll likely see much longer payment terms, including 30, 60, or even 120 days.

This potentially impacts your cash flow, preventing you from covering your short-term obligations, including compensation for your staff and paying the overhead.

As a result, there is often the temptation to solicit outside forces for solving your problems; in other words, to apply invoice factoring or invoice trading.

Making the decision to do so should be done carefully — you do not want to invite larger headaches down the road by attempting to placate a smaller one now.

Of course, sometimes such actions are necessary; for example, when the amount of an unpaid bill is huge, and therefore can be crucial for the continued existence of your business.

Cases like these, should they arise, must be discussed with your legal and accounts payable departments working collaboratively, to determine the best course of action.

For help deciding to use invoice factoring or other services to meet your cash needs, the resource below can be of use.

Infographic provided by Seacoast Business Funding – invoice factoring services