Ever heard the term friendly fraud? I hadn’t either. Not until my friend kept showing up to happy hour stressed and overwhelmed because he was experiencing it in his business.

Friendly fraud (also called chargeback fraud) is when a cardholder marks a purchase as fraudulent on their credit card transaction statement, even though it was a valid purchase.

When the consumer disputes a charge, it starts the chargeback process, which consists of the credit card company starting a 60-90-day review where the money is put on hold (neither the consumer nor the business has access to the money). The review usually sides in favor of the consumer, meaning the business has to return the money, even if the payment is credible.

No wonder my friend was stressed. He was spending time, money, and energy dealing with fraudulent dispute issues—and it was putting his whole business at risk.

How chargeback fraud hurts businesses

My friend isn’t alone: 90% of merchants say credit card chargebacks are a leading concern for their business. Here’s why.

Chargeback fees

What is a chargeback fee? Well, when a consumer wins a dispute, the business must refund the customer and pay a fee to the payment processor. A typical chargeback fee ranges from $20-$50 per dispute, which means businesses lose a sale and pay an additional $20 (at least). At scale, this can lead to major revenue issues for businesses.

Termination of payment processor account

Another big issue businesses face with chargebacks is their effect on dispute activity.

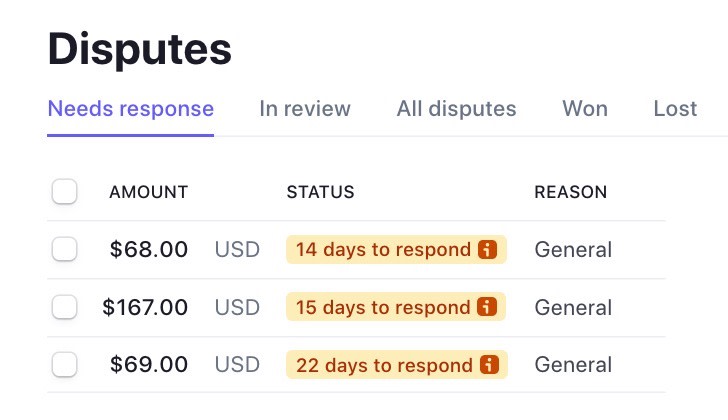

Each card network and payment processing platform has different rules about disputes and dispute rates. But if your dispute activity is too high, you’ll generally get enrolled in a monitoring program with your processing platform—which can result in the cancellation of your account.

My friend was put on this monitoring program. He had three months to get his dispute activity down, or else his Stripe account would be put on hold. And if he lost his Stripe account, he wouldn’t be able to take payments at all. He needed to find a way to lower disputes so he didn’t go out of business.

How to prevent chargebacks

Chargebacks are known as friendly fraud because the customer comes off as honest, but there’s no legal reason to dispute the charge. But not all friendly fraud is the same level of friendly—how you prevent chargebacks will depend on the type of chargeback it is.

Here are the main reasons consumers tend to mark a charge as fraudulent—and how you can handle these kinds of friendly fraud chargebacks.

Customer dissatisfaction

Customer dissatisfaction—when consumers feel deceived or scammed—is a big driver for friendly fraud chargeback. Customers feel validated in disputing a charge because they don’t believe they got what they paid for.

For example, my friend’s business provides cheap flight alerts to consumers. Of course, the company can’t guarantee that users will get a specific deal. Occasionally, when customers don’t see the deals in the destinations they want, they’ll dispute their charge.

How to prevent chargebacks from customer dissatisfaction

-

Implement stringent authentication software at checkout. The extra step for buyers to review their purchase before hitting “buy” helps ensure customers know exactly what they’re buying.

-

Make your refund policies clear and transparent. My friend made it easy to find the refund policy on their website, and he started including links for refunds in his subscription renewal emails.

-

Streamline your refund process. If users can return their purchase or cancel their membership easily (ideally online), they’ll probably try that first.

Customer confusion

How many times have you looked at your credit card statement and thought, “what was that charge?” Sometimes, consumers are just confused. They don’t recognize the charge on their credit card statement, and they click dispute instead of verifying if it’s something they approved.

My friend’s business is a subscription model, and most disputed payments were on yearly renewals. It’s the customer’s responsibility to cancel their membership, but often, they’d forget. Then, they’d see the charge for the first time in a year, not recognize it, and dispute the charge via their credit card.

How to prevent chargebacks from customer confusion

-

Send payment reminder emails. Especially if they’re not subscribed to your marketing emails, you need to remind folks that they’re a customer, so they won’t be surprised by a transaction on their credit card statement. My friend started sending reminder emails about subscription renewals, so folks knew they had a charge coming up.

-

Use explicit naming on the transaction. Be sure the credit card statement clarifies what the payment is for—it should include the name of your business. This ensures that consumers aren’t confused by a payment they don’t recognize.

Cyber-shoplifting

Friendly fraud crosses the line into theft as cyber-shoplifting. Cyber-shoplifting is when customers make a purchase with the intention of disputing the payment.

For example, although it wasn’t very common, my friend would have some customers dispute their charge as soon as they got the one flight alert they needed, even if they’d signed up for the year. This means they would get what they wanted from my friend’s business and then dispute the charge on their credit card, getting an illegitimate refund.

How to prevent chargebacks from cyber-shoplifting

-

Fight the dispute. To fight chargebacks, you need to prove the dispute is illegitimate, with evidence like receipts and signed terms and conditions. Make sure everything is thoroughly documented, so if you do have to fight the dispute, you have everything you need.

-

Use chargeback measurement tools. Utilize tools like Midigator to analyze disputes and help you fight fraud.

Build systems to mitigate chargebacks

All disputes, whether won or lost, are included in your dispute activity, so the best way to avoid issues is by trying to prevent disputes before they happen. You’ll always face disputes, but your dispute rate will drop if you begin to implement the changes listed above (like tracking receipts, streamlining customer communication, and implementing a smooth refund process). And hopefully, like my friend, you’ll be able to enjoy happy hour again.

Related reading:

[adsanity_group align=’alignnone’ num_ads=1 num_columns=1 group_ids=’15192′]

Need Any Technology Assistance? Call Pursho @ 0731-6725516