Contracts come in many forms, from consulting service agreements to licenses, real estate leases, and purchase orders.

They are used to arrange for everyday supplies and perform essential and specialized services (such as financial advisory or cloud-based IT).

With so many functions a single document can serve, how is it possible to accurately enable contract risk management strategies across your company?

Everyone involved with the negotiation and execution of contracts must understand the risks involved and employ optimal mitigation strategies for every contract they send.

Otherwise, you could land yourself in legal or financial trouble.

Don’t just hope for the best. Actively mitigate your risks by following our guide.

How to implement contract risk management in your company

-

What are contracts used for?

-

What forms do they come in?

-

What makes a contract valid?

-

What risks do you take when signing a contract?

-

How to act in the best interest of the business without assuming unnecessary risk

-

Commercial insurance

-

Reviewing the contract

-

Keep your contracts compliant with PandaDoc

Contracts 101

A contract is an agreement, either written or spoken, but preferably written, between two or more parties.

Contracts create a legal obligation because their terms are enforceable by law, with clearly defined penalties and remedies if someone breaches its terms.

What are contracts used for?

Contracts are integrated into day-to-day life.

I mean, how many times have you accepted the “Terms and Conditions” on an iPhone software update without reading it?

Even without acknowledging what these terms may or may not mean, you still entered into a contract with the company explaining how you can use the software.

While making a document long and drawn out may make your users sign your proposals, there’s a better way to learn how to ask for a contract to be signed quickly.

You’re probably using multiple contracts as we speak:

- Your mortgage or lease agreement

- Your credit card’s terms and conditions

- When you accept cookies on a website

- Your employment or tax forms

Whether you’re building a structure in the form of an actual building or in the form of a startup, at some point, you’ll need to use a contract.

Contracts aren’t just the foundational elements for every business, but human society in general.

Contracts have a profound impact on all of us, yet they often fly under the radar, even though anytime you’ve used a product or service, you’ve probably needed to sign something first.

What forms do they come in?

A contract can be written or spoken verbally. However, a verbal contract is less desirable of the two options because they’re difficult to argue in court.

A verbal agreement also can’t:

- Override a written contract

- Outline the explicit contract terms

- Protects your business and/or personal relationships

- Actively prevent misunderstanding

It’s also possible to enter into an implied contract when your terms are verbally made, which could be argued in court if there’s a presumption the agreement previously existed.

For example, if your neighbor decides to clean your gutters and you thank them, that could set the grounds for an implied contract.

If you continue to let your neighbor remove leaves from your rain spouts and you don’t tell them to stop, they may be able to ask for payment.

To avoid creating a verbal contract, state your intentions clearly.

Better yet, stick to written contracts for all of your personal or business-related needs. You can negotiate better contracts right inside PandaDoc to avoid uncomfortable situations altogether.

What makes a contract valid?

A contract is created when there is a consideration, an offer, and acceptance between two or more parties. A contract must contain the following six elements. Otherwise, it won’t be enforceable:

- Consideration: Something of value given in exchange for signing the contract. For example: Providing a user the right to use a software if they agree to its license terms.

- Offer: A promise made from one party to another that they will or won’t perform. For example: Exchanging money for a service, like shoveling the driveway.

- Acceptance: Proof that the parties involved agree to the contract terms.

- Awareness: Proof that included parties understand the terms of the contract.

- Capacity: All parties are aware and legally capable of signing. If even one of the included parties is a minor, intoxicated, or deemed unable to sign, they void the contract.

- Legality: Contracts are subjected to laws and jurisdiction in the state they’re signed.

Research your state laws to ensure your contract is legally compliant in your jurisdiction.

What risks do you take when signing a contract?

Contract exposure can put you or your organization at risk. You must have systems in place to ensure all of your i’s are dotted, and t’s are crossed before creating or signing a contract.

There are simple ways to identify and eliminate risks within your contracting process:

- Financial: Will my contract end up costing me money?

- Legal: Do the terms of my contract make it to execution?

- Brand: Can I maintain my brand image with my contract?

- Security: Am I able to protect my digital assets?

Let’s look at these risks more in-depth.

1. Financial risks

Most businesses take on some form of financial risk when drafting a contract, even if it’s just in the form of a security.

It’s common for contracts to offer up some form of collateral to back up the claims written in the deed, and this could be lost if the sender breaches their own agreement.

If you miss an important contract date and lose business as a result, you could ruin your reputation or incur significant financial losses.

Termination associated with missed milestones, warranty problems, missed delivery dates, and claims can be easily resolved on your end.

To make sure you mitigate your financial risks, use our all-encompassing business sales agreement template or one of PandaDoc other free-to-use business templates.

2. Legal risks

Legal issues occur when you have a breach of contract with the potential for legal accountability or litigation. Legal risks include dispute, regulatory, and compliance issues.

Intellectual property infringement causes, confidentiality disclosures, and a lack of using the proper legal clauses are commonly added to contracts because there’s an assumption that the agreement can overrule the law.

Even if both parties agree to the terms written in the contract, it can’t include anything that would be considered unlawful.

Your legal risk could also result from missing specific compliance requirements, such as HITECH, OSHA, or HIPAA. You can store HIPPA forms and documents with PandaDoc.

3. Brand risks

Mastering the art of personal branding as a sales pro is essential, but your clients will jump ship quickly if your contracts cause damage to your brand.

If word gets out that your arrangements are being held on an insecure channel or include unfair clauses, you may never recover.

Mitigating your brand is more important now than ever before because bad news travels quickly.

When your brand suffers, it will also impact your financial performance.

4. Security risks

Security risks can be associated with the highest and most severe consequences for a company.

While small businesses, LLCs, sole proprietors, and individuals can suffer from a security breach, it’s more likely to affect large enterprises that gather and store more data.

Learning how to add eSignatures to PDF and sign PDF documents online will save you a lot of stress because a security breach can often result in additional financial, legal, and brand issues.

When managing contracts, security risks may happen if you store your contracts in an insecure location, leave documents unencrypted, or give general security access to all users.

Sending your document over an insecure email channel can provide a backdoor to hackers.

That doesn’t mean you should rely on filing cabinets. Instead, adopt a safe and secure eSignature software solution, like PandaDoc.

How to act in the best interest of the business without assuming unnecessary risk

The contract negotiation process is split into two parts: before the negotiation and after executing the agreement. Learning how to negotiate a contract will benefit you during these steps.

Before entering into an agreement, consider your interests, risks, and allocation of risk.

Before entering negotiations, use a risk assessment matrix

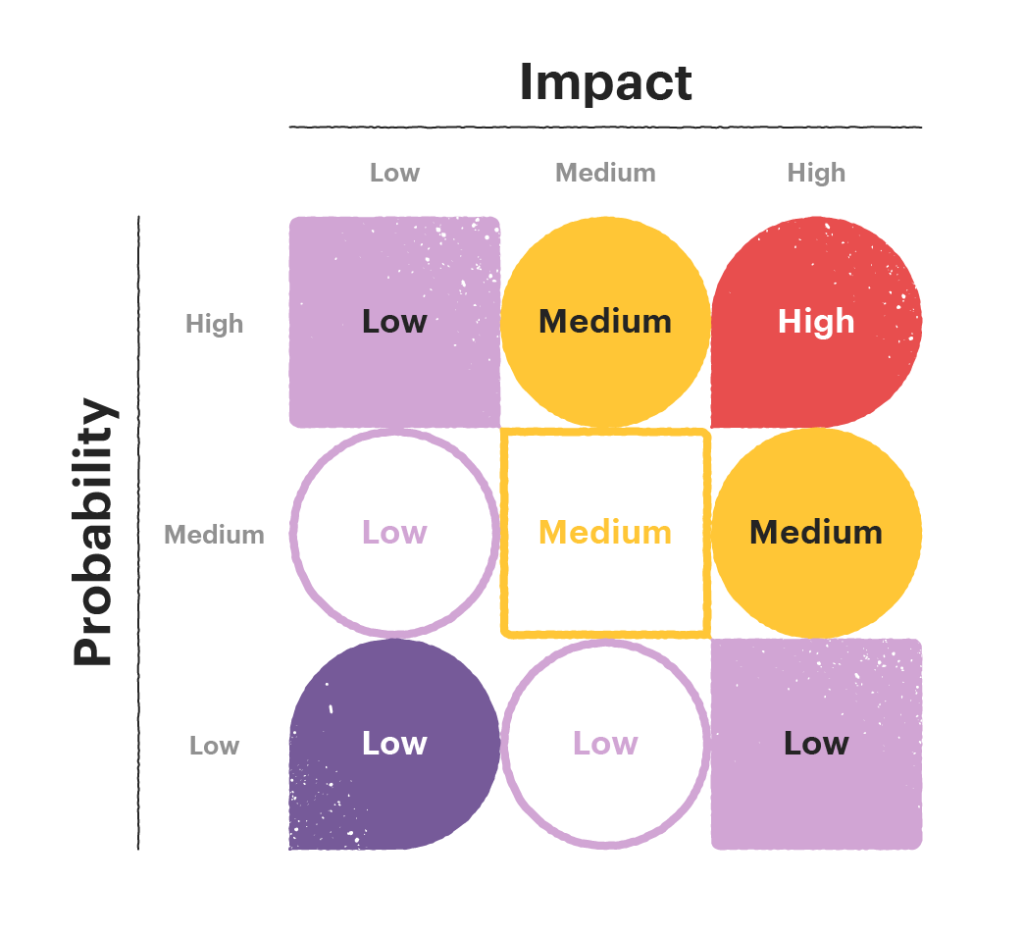

To create a bird’s eye view of your risk landscape, create a risk assessment matrix.

A risk assessment matrix is a tool that defines the level of risk by the probability or likelihood of said risk. It also spells out what will happen if your business takes on that risk.

That’s a lot of risky business, but there’s a good reason to use one. A risk assessment matrix can help you prioritize your risks and create a strategy for managing them.

To create one, you need to determine your business objectives or what you want to gain from this partnership.

Then, start by the process of understanding your business risks by:

- Identifying the risk landscape: Go back a section to “what risks do you take on by signing a contract” and begin your brainstorming session with your team or shareholders. Begin with the highest-level risks and narrow them down to specific processes.

- Determine the risk criteria: With your detailed list of all of your risks, separate them into how likely these risks will occur and what impact these risks could have.

- Assess the risks: Most businesses separate their risks into low, medium, and high. Color-code your list to make the high-risk scenarios easy to find.

Only place a scenario in the high-risk category if you feel it has an 80% chance of occurring when using the three-category risk assessment.

Anything less than a 20% chance of occurring should fall into the low-risk category. Everything else can be put around the middle.

Use your discretion. Sometimes it’s better to add 5, 7, or even 10 categories for your risk assessment.

At the end of the day, you want a document that determines if the compensation you’re receiving from the client, customer, or business owner is equitable given the risks.

Depending on the type of agreement, you may need a high level of risk tolerance to stomach the deal. Still, it’s in everyone’s best interest to come to a win-win scenario.

Before executing the agreement review allocation of risk clauses

Once you’ve drafted your commercial, business, or personal contract, determine whether the risks inherent to the relationship are addressed by specific language in the agreement.

This language can come in the form of default, representation, warranty, or allocation of risk clauses.

You’ll want to use all contract risk management tools at your disposal.

Several of PandaDoc templates use multiple clauses to mitigate contract risks.

Be sure to include the following legal protections in your agreements.

Allocation of risk clauses/contractual risk transfers

Contractual risk transfers transfer responsibility for risk exposure to one or more parties.

A contractual risk transfer can remove a person or organization initially responsible for the risk by giving it to one or more contractual parties.

Indemnification/hold harmless, limitation of liability, and waiver of subrogation are typical examples of contractual risk transfers, all of which can mitigate risks and their impact.

- Indemnification/hold harmless: A indemnification holds one party responsible for damages or losses caused by the other, usually in the form of cash payment.

- Limitation of liability: A limitation of liability is like a damage cap. It restricts how much someone can recover if they seek remedies for their damages.

- Waiver of subrogation: Under a waiver of subrogation, one party agrees to prevent the other party from allowing an insurance agency to seek legal action against them.

Commercial insurance

Most businesses will carry some form of insurance, usually commercial insurance, to ensure that some of their legal assets are still available to them if a loss occurs.

If both parties don’t have a lot of liquid assets, commercial insurance offers extra protection against being sued.

It’s important to ask your business partner if they have insurance on their assets. Otherwise, you may not receive compensation for your loss, even if you seek a remedy.

You and your team will take a second look at these risk clauses when you review the contract.

Reviewing the contract

A contract review is a thorough examination of a legal agreement before it’s signed to ensure everything stated in the document is clear, accurate, and can be understood by both parties.

Following a contract review, both parties will either agree or disagree with the terms of the agreement.

If the parties disagree, they’ll move back towards the negotiation stage.

If both parties agree, the contract will be signed and be deemed legal.

After an agreement is signed, both parties should review the contract regularly, especially when leading up to a specific contracting event, like opt-out windows or re-negotiations.

For example, if you were using the small business partnership agreement template from PandaDoc, you may want to increase the amount of capital each partner contributes when you scale.

If you have shareholders, this may increase the percentage they own of the company.

Have your contract reviewed by a knowledgeable person

Your company’s procurement department, general counsel, or another knowledgeable member within your corporation should review your contract.

Not once, not twice, but as many times as you need to be sure.

When it comes to reviewing a contract, the more, the merrier, as multiple sets of eyes can help you find business risks you didn’t even consider.

Someone reading a contract for the first time is more likely to see typos or errors than the person who drafted the agreement.

Eventually, your eyes will glaze over, and so will your team’s. It may be in your best interest to hire a contract review lawyer (or two) if you want to ensure your contract delivers as intended.

Take advantage of technology where you can. There are over 7 HIPAA documents that you can send with PandaDoc, meaning you’ll meet HIPAA compliance standards through our platform.

What does the review entail?

A contract review is a common way to conduct contract risk management and usually includes reviewing the key clauses, termination and renewal terms, and the critical dates and deadlines outlined in the document.

Contract risk management reviews will also include:

- Estimating the extent of identified risks associated with the desired business venture.

- Deciding whether the projected risks exceed the buyer’s risk appetite.

- Evaluating and implementing appropriate transfer or financing mechanisms for losses that are beyond declared risk tolerances.

A lawyer is likely to look over blank space and the default terms of the contract to make sure the language you’re using is clear and unambiguous.

This is important because any language left up to interpretation could be used against the contract sender.

What’s more, blank space in a document could be filled in with something else.

During your review, delete all empty spaces in your contract, or it could lead to costly consequences.

A review may pull from your risk assessment matrix to see if you and your business partner are aware of what may be gained or lost from this agreement.

Even if your terms were initially set in stone, your risk assessment matrix might spell out some red flags about the deal.

Keep your contracts compliant with PandaDoc

Writing, signing, and sending a contract can be risky, but it doesn’t have to be. It’s possible to initiate a contract risk management strategy across all of your documents.

You can even ensure your templates stay compliant with federal and state laws.

That means when you send over your freelance contract template to your clients, you don’t have to worry about personal information slipping through the cracks.

With PandaDoc, you can keep your contracts nestled safe and warm in and around our systems.

Since you can sign and send for eSignatures directly using our 14-day free trial, but we have a feeling you’ll stay longer.

Looking For Document Management System?

Call Pursho @ 0731-6725516

Check PURSHO WRYTES Automatic Content Generator

https://wrytes.purshology.com/home

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads