Sending an invoice should feel like a mini-celebration—a quick, easy task to signify the end of a project and a job well done. In reality, creating and sending an invoice, accepting payment, and following up with clients can be a time suck, and one you’re not getting paid for.

Streamline your invoicing workflows with automation

Invoicing software can automate the manual, repetitive steps. You’ll be able to generate invoices directly from contracts or estimates, share the invoice via email, text, or snail mail, and accept credit cards, debit cards, and wire transfers.

We tested dozens of invoicing apps, and these are the six best. Click any app below to see why we chose it, or keep reading to learn more about invoicing software.

The best invoicing software

-

PayPal for invoicing clients who have PayPal accounts

-

Stripe for securely accepting wire transfer payments

-

Zoho Invoice for sending paper invoices by snail mail

-

AND.CO for generating invoices from contracts

-

Square for turning estimates into invoices

-

Invoice2go for sending invoices by mobile messaging apps

What makes great invoicing software?

First and foremost, invoicing software should:

Those are the must-haves, but we were also looking for how easy the apps were to use—creating an invoice should only take only a few clicks. Instead of creating a new document and typing everything in manually each time, you customize your invoice app once, track ongoing projects, and let the app generate the invoice.

When testing apps, we focused our research on hosted invoicing software (if you’re interested in self-hosting your invoices, check out Invoice Ninja). We looked for apps with either unique or extensive features—those that do something no other app offers. We also considered pricing, but because we have a roundup dedicated to free invoice software, we expanded our testing to include paid apps.

We also prioritized software primarily designed for invoicing or ones that offered a robust, standalone invoicing feature. We excluded accounting software: while many do offer impressive invoicing features (like QuickBooks and FreshBooks), they work best when you use the whole accounting suite together, which can be overwhelming if you’re just looking to send an invoice. If you’re interested in accounting tools, read our roundup of the best accounting software.

Note: Quoted payment processing and transaction fees apply only to payments sent to and received from individuals within the United States. International fees may vary by both provider and location.

Best invoicing software for invoicing clients who have PayPal accounts

PayPal (Web, iOS, Android)

PayPal is one of the most popular payment gateways, so there’s a good chance many of your clients already have PayPal accounts. Plus, PayPal’s name recognition and reputation may alleviate any concerns they have with paying you online.

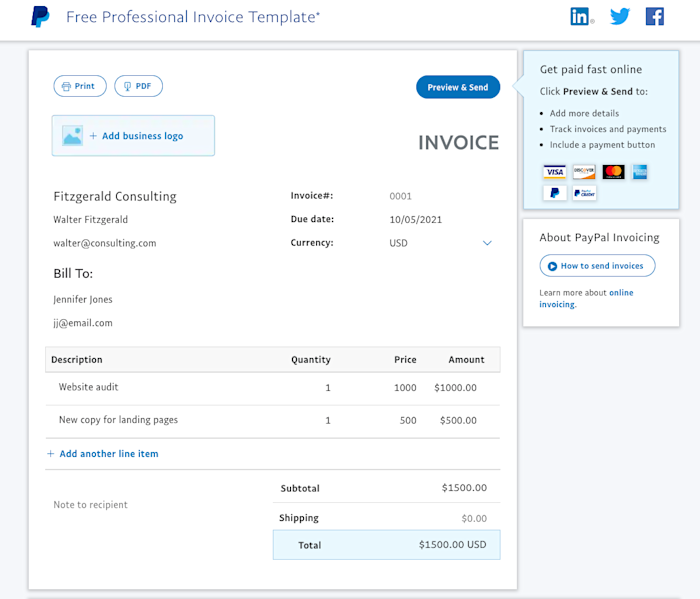

You can create a basic invoice that you can download or print without even having a PayPal account. However, to accept payments by credit/debit card, PayPal Credit, or PayPal balance, you’ll need a free PayPal Business account. You’ll also get additional features like the ability to save your invoice template for future use, email invoices directly to your customers, and track invoices and payment status.

When clients pay, the money is added to your PayPal account. You can transfer your PayPal balance—subject to certain limits—to your debit card or bank account at any time.

PayPal invoices are simple. You can upload your business logo, specify the due date and currency, and quickly add descriptions, quantity, and price for each line item. With a PayPal Business account, you can also create recurring invoices and allow clients to make partial payments or add a tip.

Even if your clients don’t have PayPal accounts, you can still invoice and accept payments from them. Clients can also pay their invoice with PayPal Credit and get financing for up to six months on purchases of $99 or more while you get paid in full, upfront.

PayPal also integrates with Zapier, letting you send invoicing and payment details to the other apps you use for your business.

PayPal price: Free to create an account and send invoices

PayPal payment processing fees: 3.49% + $0.49 per domestic transaction

Best invoicing software for securely accepting wire transfer payments

Stripe (Web, iOS, Android)

Stripe’s powerful suite of online payment processing tools includes invoicing and a unique feature: the ability to accept wire transfer payments without exposing your bank account information.

Occasionally, you may run across a client who insists on paying via wire transfer. The problem: to accept a wire transfer payment, you have to divulge sensitive financial information, including your bank name, routing number, and account number.

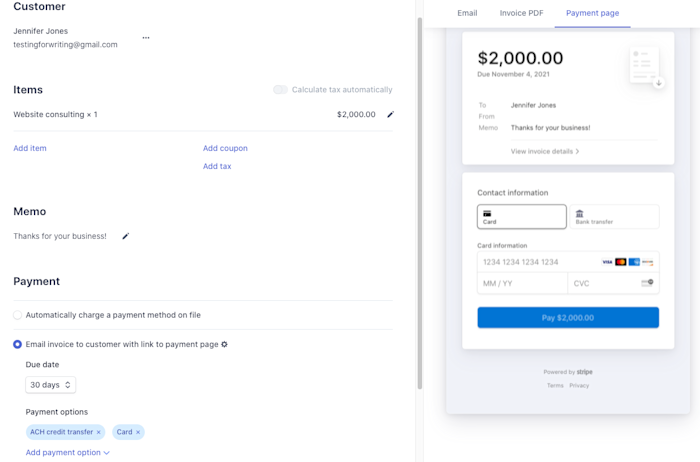

Stripe Invoicing lets you generate virtual bank account numbers when accepting wire transfers, protecting your private banking details. It also automatically reconciles incoming wire payments with outstanding invoices, saving you time. The wired funds are then added to your Stripe account and automatically transferred to your bank on the schedule you specify.

Stripe also offers the other features you need from invoicing software, like automatically collecting sales tax, accepting payments via Apple Pay and Google Pay, and using Smart Retries to retry failed invoice payment attempts at optimized times to increase the chances that you’ll get paid. You can also populate invoices with pre-saved customer details or customize your invoice with your own branding.

And thanks to Stripe’s integration with Zapier, you can do things like send Gmail emails for new Stripe events, get Slack notifications for new Stripe customers, or connect Stripe to thousands of other apps.

Stripe price: The Starter plan is free for 25 invoices per month, and costs 0.4% per invoice after that. The Plus plan includes advanced features to automate invoice collection and reconcile invoice payments and costs 0.5% per paid invoice.

Stripe payment processing fees: 2.9% + $0.30 per transaction for credit/debit card payments; from $8 per wire transfer payment; 0.8% with a $5 cap for ACH Direct Debit payments

If you can’t decide between PayPal and Stripe for your payment gateway, check out our detailed Stripe vs. PayPal breakdown.

Best invoicing software for sending paper invoices by snail mail

Zoho Invoice (Web, iOS, Android)

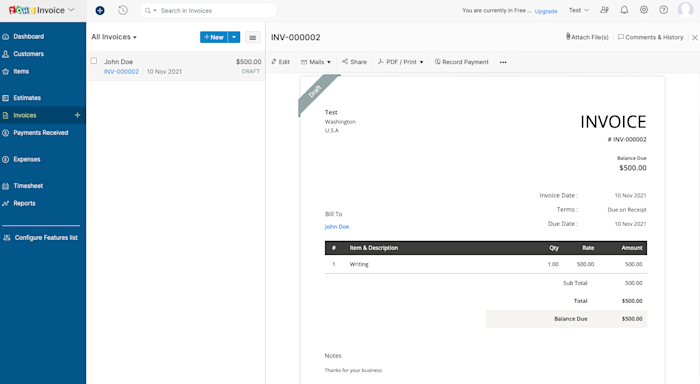

Zoho Invoice can automatically make invoices that match your company’s brand and then mail them to your clients. After inputting your company details and selecting one of a handful of standard templates, you can quickly create invoices with a form that helps you add line items, taxes, and details.

You can email the invoice immediately—or schedule it to be emailed later. If you have a client who prefers paper, use the Send Snail Mail option under the Mails menu, and Zoho will professionally print and mail your invoice inside the U.S. for $2, complete with a detachable payment stub, so it’s easier for you to track the payment, and a return envelope, so customers can mail back their payment. It’s a great way to automate invoicing even when you still need to use paper.

You can automate your invoicing process even further with Zoho Invoice’s Zapier integrations, which lets you connect Zoho Invoice to any of the other apps you use for your business.

Zoho Invoice price: Free

Zoho Invoice payment processing fees: Payments accepted through Zoho Invoice are made through third-party apps like PayPal, Stripe, and Square, so transaction fees vary based on the terms of your selected payment gateway.

Best invoicing software for generating invoices directly from contracts

AND.CO (Web, macOS, Chrome, iOS, Android)

AND.CO is an invoicing, time tracking, and task management app designed specifically for freelancers, and it offers pretty much everything you need to run and manage a freelance business. Build proposals, track time worked toward clients and projects, generate invoices quickly from your timesheets, and accept payments.

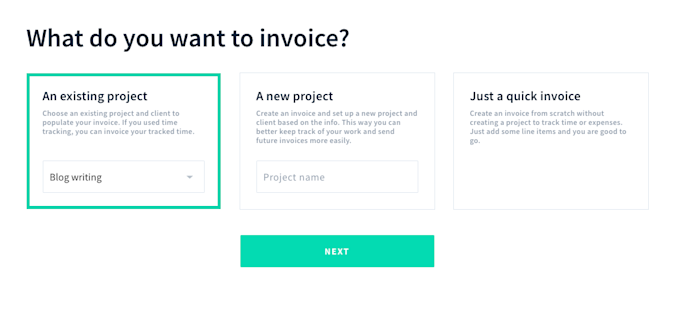

But AND.CO offers one standout feature: it automatically populates invoices for you based on your contracts and projects.

Creating a contract is easy with templates provided by the Freelancers Union. You can customize the template with your project terms and fees, select which clauses you want to include (like non-compete, late payment fees, or ownership rights), and even collect eSignatures.

Then, when it’s time to bill for your work, you can create an invoice from an existing project and choose to send the invoice once or on a weekly, monthly, or custom basis (or invoice when you hit certain milestones). You can also create an invoice and set up a new project at the same time, or send a quick invoice from scratch. If you create an invoice from an existing project, the work and fees you outlined in the contract will automatically populate. Just review the details and click send.

As an added bonus, AND.CO integrates with Zapier, helping you automate your entire freelance workflow by connecting AND.CO to the apps you use most.

AND.CO price: Free for one active client. The pro plan is $18/month for unlimited clients, editable contracts, and the ability to remove AND.CO branding.

AND.CO payment processing fees: Payments accepted through AND.CO are made through Stripe or PayPal, so transaction fees vary based on the terms of your selected payment gateway.

Best invoicing software for turning estimates into invoices

Square (Web, iOS, Android)

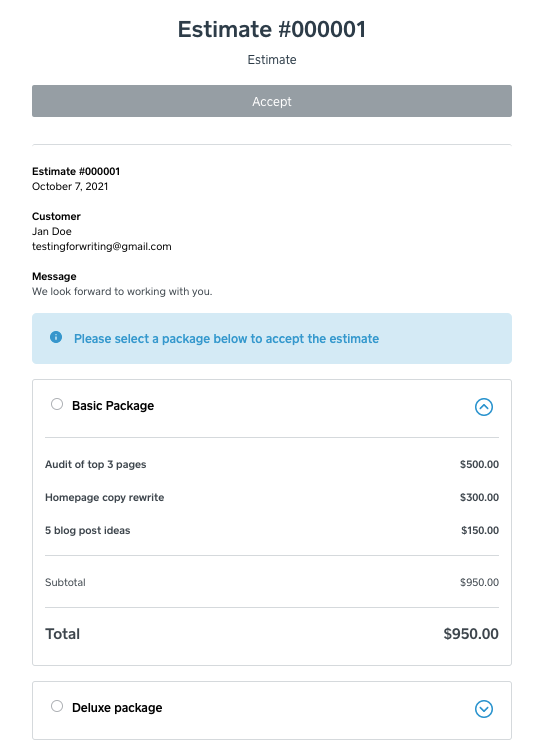

Before you can even think about sending an invoice to your customer, you both need to agree to a price. While most invoicing software allows you to create estimates and quotes, you can only send one estimate at a time. If your customer rejects it or wants to negotiate, you have to create and resend a new estimate. When they finally do accept, you have to relocate the right estimate and turn that into an invoice.

With Square Invoices Plus, you can offer multiple packages from a single estimate and automatically convert the accepted package into an invoice. This allows you to spend less time scoping and pricing projects, and eliminates the back-and-forth with customers.

For each package, you can add a title, description, attachment, due date, and date of service. Then, you can add the line items and pricing that make up the package. You must display at least two packages (with a maximum of nine), and each package’s total must be between $1.00 and $50,000. An added bonus: you can add a payment schedule for each package, splitting the cost due into increments over time.

Customers can receive the estimate via email, text message, or link, and can instantly select and accept a package. Once they do, the invoice is immediately generated, and they have the options to pay by card or by Google Pay right away.

You can automate your workflow even more by connecting Square to Zapier, which will save you manual effort getting your info from one app to another. Here are some examples.

Square price: $20 per month for Square Invoices Plus for the ability to create multi-package estimates. Or, send unlimited invoices, estimates, contracts, and more for free.

Square payment processing fees: 2.9% + $0.30 per transaction

Best invoicing software for sending invoices by mobile messaging apps

Invoice2go (Web, iOS, Android)

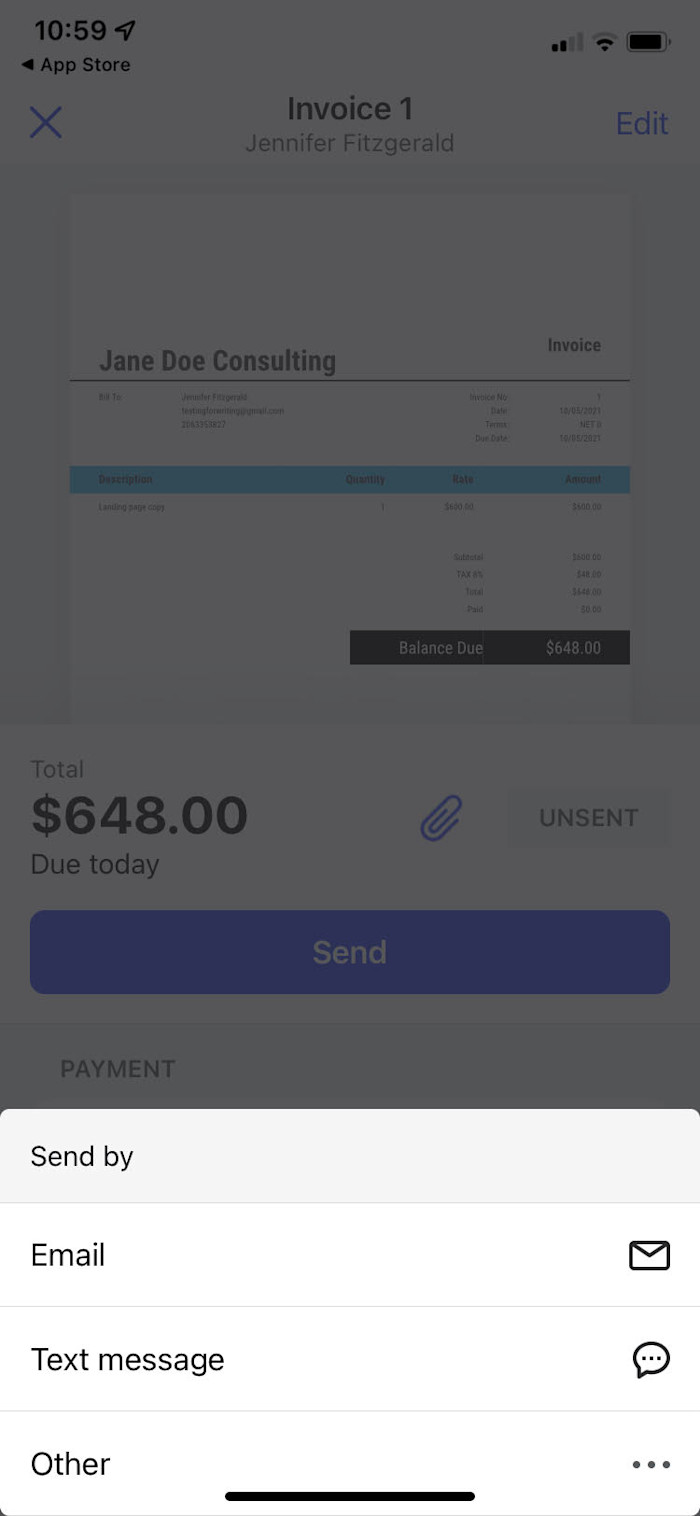

Digital invoices can easily get buried in your clients’ inboxes. Invoice2go helps you stand out and get paid faster by letting you send invoices from any messaging app on your phone.

On the iOS or Android app, simply fill out a handful of fields to create an invoice. You can then choose to send the invoice by email, text, or any messaging app on your phone, including Slack, WhatsApp, Google Hangouts, and Facebook Messenger. Your client will receive your message with a link that directs them to the Invoice2go portal where they can view, download, and pay their invoice online.

You don’t need to worry about any sensitive data being shared through these messaging apps, either—payments go through Invoice2go’s secure online portal, powered by Stripe, so all payment information stays safe and secure.

Invoice2go price: $5.99/month for the Starter plan that includes five invoices per month. The Premium plan is $39.99/month and includes unlimited invoices, recurring invoices, and lower payment processing fees.

Invoice2go payment processing fees: Card payments accepted through Invoice2go are made through Stripe. Transaction fees depend on the plan type and are the lowest for the Premium plan, at 2.9% + $0.30 per transaction.

Originally published in July 2017 by Matthew Guay, this article has also had contributions from Jessica Greene.

[adsanity_group align=’alignnone’ num_ads=1 num_columns=1 group_ids=’15192′]

Need Any Technology Assistance? Call Pursho @ 0731-6725516