How do homeware brands successfully use social commerce? Here are a few pointers from Deft’s ‘Social Commerce’ report, along with some further analysis of how UK homeware brands can drive success through digital.

In China, social commerce sales are predicted to reach over $363 billion in 2021. Western markets, however, have not seen the same speed of implementation and adoption of social commerce features.

That doesn’t mean consumer desire for social commerce is absent. New research suggests that consumer willingness to buy on social platforms is rising, with a UK shopper survey finding that nearly two in three people would be more likely to purchase from a brand if they could browse and shop entirely within a social media platform.

At the same time, with platforms like Instagram and TikTok slowly rolling out new shopping features, we could see rapid acceleration of social commerce in the next couple of years. Social commerce creative consultancy Deft suggests that now is the time to invest in social commerce strategies. In its report ranking homeware retailers in the UK, Deft states that “companies that are leaders in social commerce are the next growth pioneers.”

Combine emotional and rational abilities

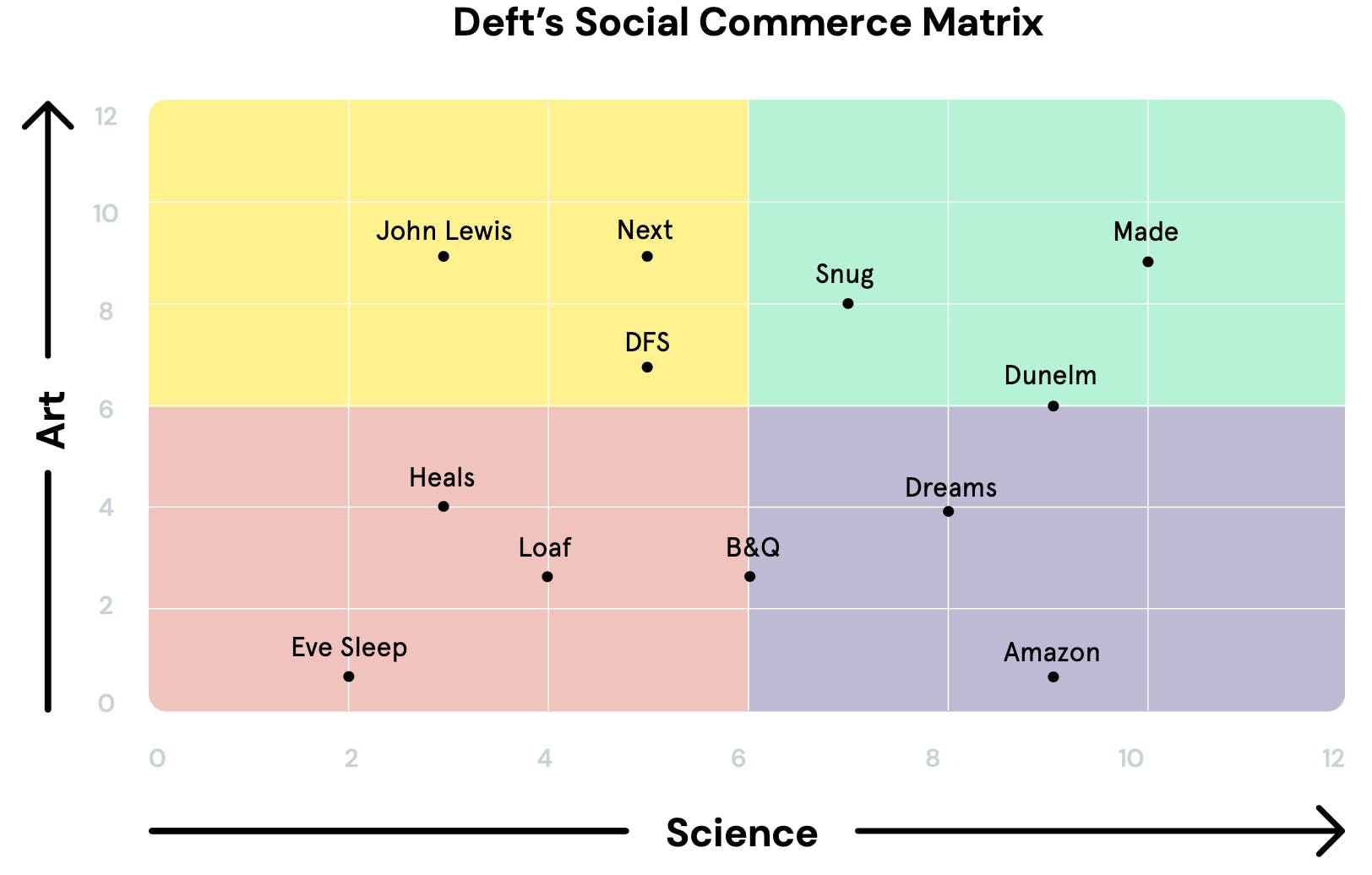

Deft’s social commerce matrix measures the extent to which homeware brands are best positioned for growth within the sector, by identifying six quantitative metrics of a brand’s social commerce offering. One key dimension, for example, is scale, relating to the number of channels a brand is active on. Another is fame, which highlights how a brand earns (and retains) the attention of its audience.

Overall, leading homeware brands – which Deft identifies as Snug (a Deft client), Dunelm, and Made – were found to “combine an analytical view of the funnel with bravery to make big bets.” Essentially, this means that they have a combination of art and science dimensions, with both the emotional ability to connect with audiences and the rational ability to leverage platforms and behaviour through the funnel.

As such, the challenge for these brands is to find ways to keep innovating against new competitors and changing consumer behaviour.

Syndicate product catalogues into social platforms

According to Deft, one way to innovate for growth is by executing a mobile-first social commerce experience. This is made possible by new features on Facebook, Instagram, and TikTok, which enables brands to syndicate their product catalogues into social platforms, thereby allowing users to browse and, in some cases, buy (though perhaps not yet purchasing high-ticket items like sofas) without having to visit a brand’s website.

The benefits are huge. Not only does it help brands to power catalogue-based advertising, which can effectively prompt users to browse products in the moment (compared to more general, brand-focused ads), but it also encourages a ‘shopping mind-set’, encouraging consumers to shop wherever they are.

Next is one UK homeware brand that effectively uses mobile-first commerce, with its Facebook and Instagram stores enabling consumers to seamlessly discover new products as they browse on social. Determined as an ‘artist’ on Deft’s matrix, Next’s use of mobile commerce is an example of its ability to understand both its customer and brand.

Tap into organic appreciation on TikTok

TikTok’s growth has been rapid in the past three years. In September 2020, Bloomberg reported that the platform had 17 million regular users, with the average UK user said to be active on the app for 66 minutes a day, opening it around 13 times in 24 hours.

For brands, one of TikTok’s biggest opportunities is its organic user generated content, whereby users create videos related to specific brands and products. In turn, products can often gain cult status or ‘go viral’ on the platform, which can directly translate into sales. By creating campaigns based around these trends, brands are able to further awareness and foster loyalty as well as drive sales of products.

Interestingly, Deft explains how Dunelm has missed an opportunity to tap into its TikTok fame, with the brand not yet creating its own presence on the platform – despite users celebrating Dunelm’s £8 mirror in a series of videos. This is unlike Snug, which has effectively capitalised on existing love for the brand (and the popularity of ‘unboxing’ videos) – as well as the demand for general homeware content on TikTok. With more commerce features predicted to arrive on TikTok this year, Deft suggests that now is the time to “build your TikTok profile and content muscles.”

@snugsofa Wait until the end to see the cutest little surprise ???????? #littlefriends #snugsofa #snug #sofa #comfy #interiorsoftiktok #foryoupage #sofainabox

♬ original sound – JamesBayMusic

Invest time and effort in online reviews

With online home and garden sales continuing to rise – up 120% in Q1 of 2021, according to the IMRG Capgemini Online Retail Index – online reviews have never been more important for brands. They aren’t just an effective way for brands to influence decision-making – they can also boost overall online visibility and re-enforce trust and transparency.

Online reviews don’t just ‘happen’, however, with brands that actively invest in improving their overall reviews seeing marked success.

According to Deft’s research, the homeware brands with lower review scores tend to be those that run their own review systems for products within their platforms (rather than investing in external reviews). In contrast to this, brands like Dreams and Eve, which prioritise reviews across their own and third-party channels, appear to generate more positive favour overall.

Take inspiration from China

Finally, when it comes to future inspiration, Deft suggests that homeware brands should take heed of innovation in China. While the west does not have the same advanced functionality, in China, “platforms like WeChat and PDD combine elements of e-commerce, live streaming, group buying, and mobile payments supported by an advanced influencer industry.”

Deft says its livestreaming work with Snug for its Cloud Sundae 3-seater sofa launch drove 10,000 registrations for the sofa, as well as record-breaking site traffic and sales.

This, interestingly, is despite the fact that Instagram currently has no direct sales link from Instagram Live in the UK, which is a positive indication of how retailers might be able to capitalise on the opportunity once more established live-streaming commerce features come into play in future.