Björn Darko, VP of product at Searchmetrics, explains the power of search data, which some brands are exploring, and how it can be added to your market research armoury to support insight and decision making

Understanding customer needs and behaviour, coupled with market intelligence are among the keys to making successful marketing decisions. However, traditional market research methods such as surveys and focus groups can have their limitations, which is why some brands are exploring search data for additional insights.

The pace of change in many markets means traditional research can quickly go out of date, meaning you’re forced to repeat surveys at frequent intervals or buy new research reports. And, of course, the accuracy of survey findings varies with the size of your sample – and the bigger the sample, the greater the cost.

Added to this, if you’re using survey data there is the issue of whether respondents answer questions honestly. Their responses can sometimes be influenced by emotional factors or what they feel they should say because it’s socially acceptable.

The power of search data

Search data such as the keywords people use on search engines such as Google, Bing and Yahoo, the monthly volume of searches for a set of related keywords, the share of search for your brand and its rivals, and the Cost Per Click trends for your keyword set provide an additional way of understanding customer behaviour and market trends on a far larger scale.

Given that Google processes around 3.5 billion searches a day, search provides a huge, scalable, accessible dataset that is always up to date. As well as being helpful for the SEO team, it can provide value to the market research/insight team, helping to support decision making in a variety of areas from marketing and sales to product management and product development. As it’s based on people’s actual behaviour, search is often more reliable than asking a limited number of people what they think.

Here are four key ways that adding search data to your market research armoury can support insight and decision making:

1. A proxy for market demand

If you’re considering entering a new market or deciding between several product/market opportunities, you need to understand the potential market size or level of demand. But up to date market data is not always easy to get hold of – especially if it’s a niche or a new product category. Collating data on the transactional searches related to a product category can provide a solid approximation of market demand, because of the millions of searches carried out within that specific category.

Take the example of a major sports brand. With search data we can get an understanding of overall market size, as well as compare the various product categories. This brand’s product range is enormous – with over 250,000 different products, spanning 70 categories, from running and rugby to skiing. This adds up to over 1 million keywords, which can be grouped into 500,000 related clusters. By analysing search data, it’s possible to evaluate market demand for each and every category, how it is changing over time and by season, using data that goes back up to ten years.

2. Clues to drive inventory, marketing and production management

Search data enables you to take a fresh look at what inventory you need to keep in your stores and the timing of your marketing campaigns. Going back to our sports brand, it traditionally only marketed ski clothing in Q4 of each year to reflect traditional seasonal purchase patterns. But analysis revealed that searches for ski clothing now continue strongly into Q1, at 90% of search demand, providing the opportunity to sell more over a longer period.

Insights such as this can impact entire production and marketing schedules. The brand previously launched new rugby boots in September, for example, but analysing search data revealed that the highest volume of searches was actually in May. So, the company brought forward production to launch new boots earlier to deliver on customer needs.

Search data can also point to long term demand patterns such as the overall increase in demand for skiing apparel….

Or the long-term decline in interest in Zumba apparel…

3. Understand the competition (and potential distribution or media partners)

Analysing search results for the cluster of keywords around your products can show you who your competitors are, helping you identify new entrants or companies you may not be aware of. And analysing your share of search (the share of the results for a product category owned by your brand) provides a good estimate of the ‘share of voice’ or ‘share of content’ generated by your marketing against your main rivals.

Of course, search results will not only help you identify and analyse your direct competitors, but also other sites that rank highly for the same topics. For example, by showing you which media sites, bloggers and influencers rank in top positions for the issues related to your products, search results can provide valuable insights for your publications and blogs to target as part of your PR, advertising and influencer marketing strategies. If you are a manufacturer that sells through online retailers, you can identify high ranking ecommerce sites that might potentially stock your products – highlighting partnership opportunities

4. Business intelligence on changing customer behaviour

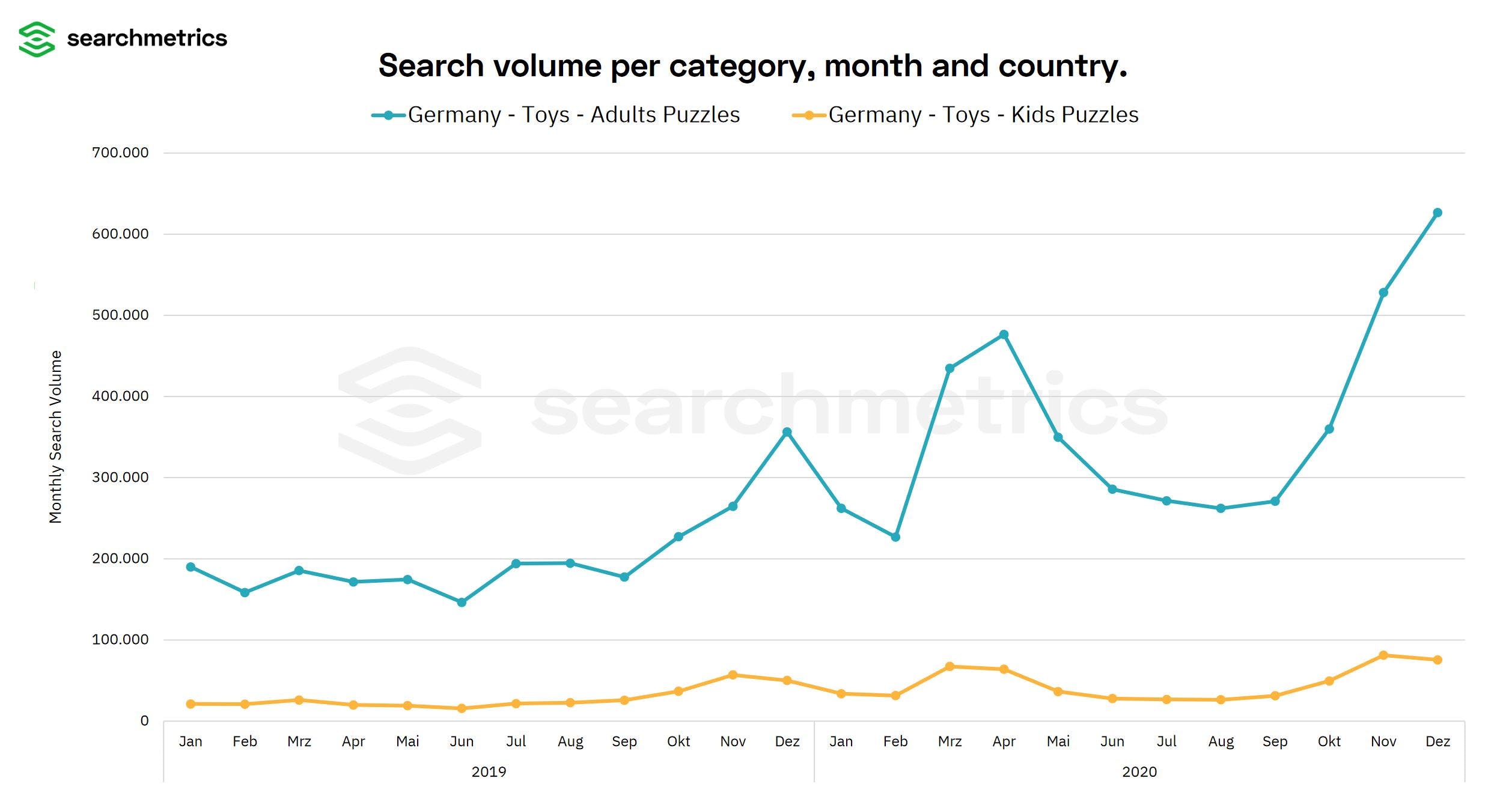

Keeping abreast of search patterns can provide hints on how consumer behaviour is changing in your sector and point to areas you need to investigate further. For example, during 2020, the COVID-19 lockdowns triggered a big increase in searches for jigsaw puzzles for adults, while those for children had a flatter curve. If you operate in this sector it is worth exploring how this will impact the market going forward.

Similarly, there were more searches for 2,000-piece puzzles last year than in 2019…

Traditional market research has much to offer and continues to evolve in order to help support data-driven decision making. But adding search data to your toolkit provides another layer of insight, giving you access to an enormous, continuously updated pool of data, based directly on consumer behaviour. It would be wasteful not to make greater use of this treasure trove of data within your insight and marketing programmes.

Further reading:

Econsultancy’s SEO Best Practice Guide includes a number of sub-guides, including measurement and reporting, and audience analysis.