Adobe’s Digital Trends 2021 report highlights the financial service sector’s digital adoption efforts in the face of huge disruption, and the barriers it needs to overcome in order to reach total transformation.

With branches shut and telephone services over-run during Covid-19 lockdowns, (previously unwilling) customers have been forced to interact with financial companies via digital channels. NatWest Group, for example, states that it saw over 500,000 new mobile app downloads and 485,000 new online banking customers in the first half of 2020 alone.

Adobe’s 2021 Digital Trends: Financial Services & Insurance in Focus report, carried out in association with Econsultancy, indicates that this shift in customer behaviour is continuing, with 54% of financial services and insurance firms surveyed reporting unusual growth in digital/mobile visitors in the past six months.

Consequently, this digital growth has also opened up new opportunities for companies; 37% of all financial services executives surveyed reporting that digital and mobile currently accounts for half or more of their sales.

A new drive for ‘meaningful digital interactions’

Despite the rise in usage of online channels, financial organisations still need to recognise the need for in-person interactions – as well as take into consideration any shifts in the reasons why customers might seek this out.

For example, Bain & Company notes that, in the US, there has been a rise in retail banking customers using branches to seek out financial advice (rather than to complete transactions that they can now complete online). This has led Citizens Bank to transition some of its branches to ‘advice centres’.

Where customers do want to interact via digital channels, Adobe’s research suggests that there is a new focus on making these moments ‘meaningful’. Forty-nine percent of survey respondents cited “meaningful digital interactions that improve customer’s financial health” as a top priority for their organisation, while 35% also cited “faster time-to-market with new products and services.”

Legacy systems (and silos) are holding back organisations

As well as interactions that go further than basic ‘transactions’ – such as advice that helps customers control their spending, as well as general information on financial topics – customers also want organisations within financial services to understand their specific needs.

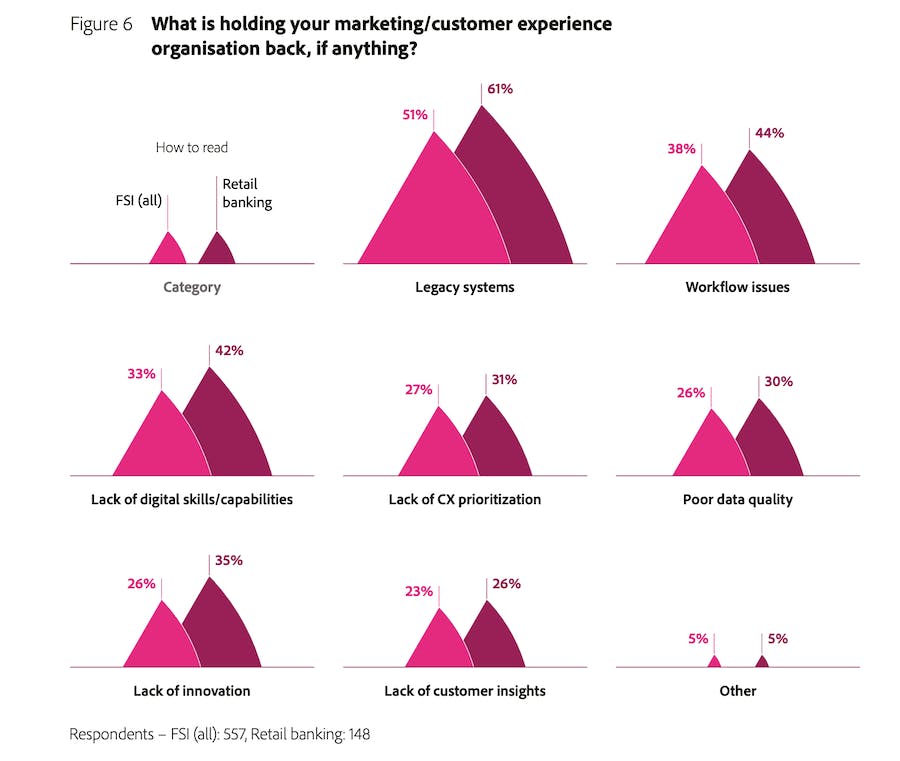

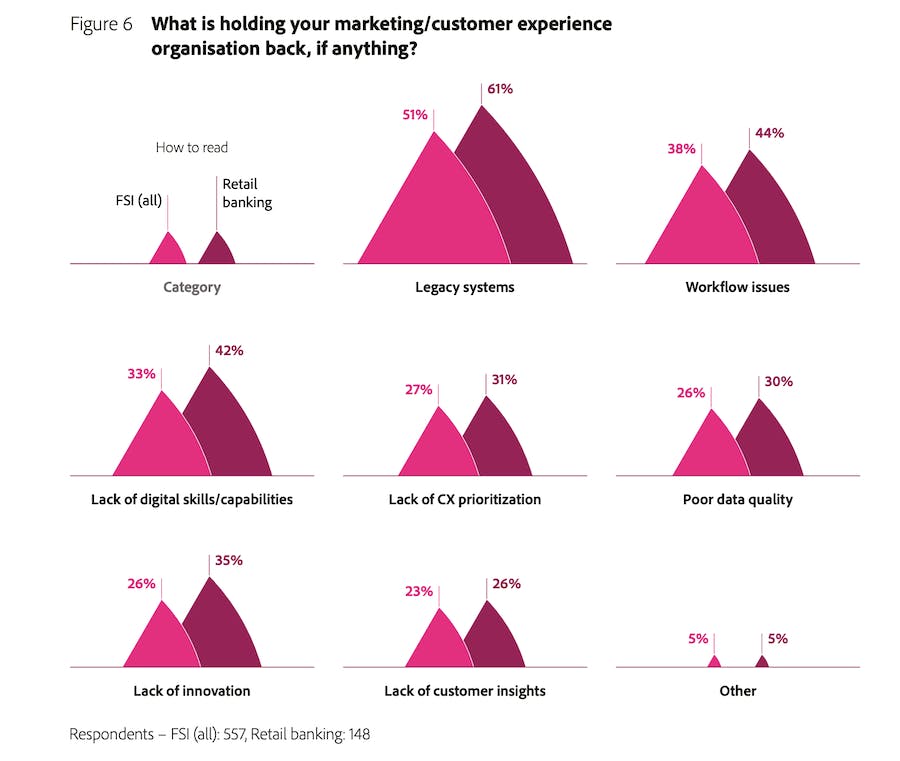

However, the research suggests that there are still big barriers preventing financial services from delivering an experience that meets customers rising expectations. Adobe’s survey found that legacy systems remain a big issue, particularly within retail banking, where 61% of respondents cited this as a factor holding back marketing and customer experience. These outdated systems and workflow issues result in silos, and an overall inability to create a joined up CX.

The good news is that there is an increasing recognition of this barrier, and a rising willingness to break through it. In Adobe’s survey, 53% of organisations cited “modernising of core systems/technology stack integration” as a top area of focus for digital initiatives.

While Covid-19 has undoubtedly created momentum within the digital transformation of many financial service organisations, there’s still work to be done in order to maintain it, as well as make further progress once the pandemic has passed.