With the launch of a brand mascot, Brobot, Reliance General Insurance case study explains how the brand aimed to build a simplified digital service experience at each stage of the customer journey.

The Reliance General Insurance Case Study shows how the brand aimed to connect with people across different age groups with the message Tech + Heart, through social media. The case study analyses how Reliance General Insurance leveraged the technology to enhance personalized services.

Category Introduction

Health retail is under 3% and India shares the largest out of pocket on medical expenses. Similarly in terms of Home Insurance, the country witnesses so many catastrophic events like cyclones and floods round the year causing crore of damages. But the claims we as insurers pay amounts to just 10% of these damage because the rest 90% of the amount gets paid by the victims from their own pockets

The GDP contribution being less than 1%, looks concerning. It implies a huge underlying potential for general insurance as a category to grow. This will happen when the sector invests heavily in driving awareness and digital has come out as a strong medium to increase the reach and awareness in the category. With the growing internet penetration, companies have invested in building a robust digital architecture and COVID helped in accelerating this further. Companies have started connecting with customers on real-time basis but virtually.

Brand Introduction

Through its products and services, Reliance General Insurance makes insurance accessible and affordable for customers. With the help of mobility, social media, digitization supported by the power of analytics has resulted in Reliance General Insurance migrating to digital products and digital distribution strategy.

Summary – Reliance General Insurance Case Study

During COVID-19, RGI aimed at simplifying the entire insurance process for it’s customers so that they can easily access its products and services from the safety and convenience of their homes, without having to interact with our physical touch points at all.

While this increased the seamless digital interactions, it also decreased in some way the physical touch and the humane values that the insurance industry is built on. Thus, the brand decided to own the dimension of Tech + Heart and make sure the efforts laid in this direction get established across all stakeholders.

Problem Statement/Objective

The objective of the campaign was to re-enforce Reliance General Insurance’s positioning as a new-age general insurance brand, that offers customers the convenience of Technology along with the empathy of a Human Heart and extends the brand philosophy of LiveSmart to all our stakeholders.

Brief

Customers when they interact with an insurance brand want speed, transparency, and care. Hence, it was important for the brand to stay away from category generic and create a newer, fresher conversation both in terms of look, tone, and feel. It was imperative for RGI to create a new world where the product and services are governed by tech and driven by heart, which brought the company to a new brand articulation Tech+Heart = LiveSmart

Creative Idea

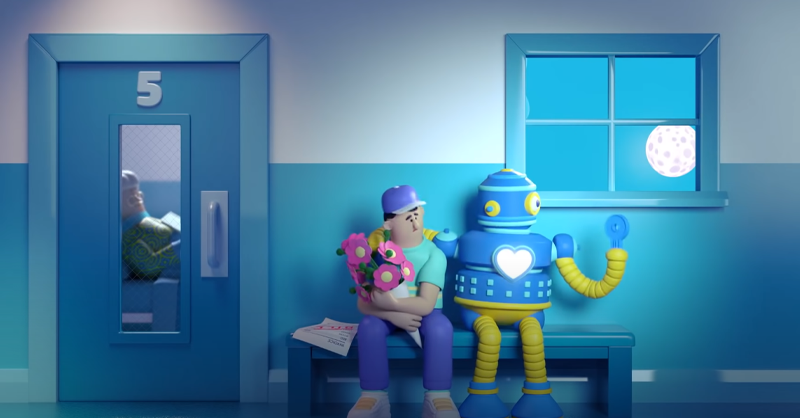

The idea was of having a unique world that is different, yet connected and having a mascot from the world you are the reflection of this ethos.

Challenges

To bring a perception shift for the Brand from a Traditional Insurance company to a brand that connects well with the masses Digitally+ with Human Heart.

Also Read: Case Study: How Weikfield established their custard as THE companion for IPL through celebrity influencers

Execution

The campaign was executed in three phases-

1st Phase: The main idea was to connect with the masses and to show how people when in dire need of help are always hoping that someone would come to their rescue. A set of teasers a week prior to the launch by the name of ‘BroBot’ were released without unveiling the brand or product mention. An entire ecosystem was created on social media platforms like Facebook as a strategy to create curiosity amongst the masses.

2nd Phase: The main film was launched over an exclusive YouTube Live on the lines of how movies are launched on the OTT platforms with a countdown to the show. The campaign began with a set of 3D animated characters distressed under different circumstances in their lives and BroBot enters to rescue them as a superhero, with the power of insurance solutions that are both tech-enabled and compassionate.

RGI used Radio, Advertising, Marketing & digital media to convey our messaging through interviews, press release & articles.

3rd Stage: Post Event interviews, case studies and social media platforms are used for various other communications related to Brand campaign.

Results

- 66.5+ Mn Reach across the paid media platforms

- 24.2+ Mn Views (cumulative) on the video platforms

- 1L+ Lift in Awareness via Youtube & 2.1pts Lift in Brand Recall via Facebook

- ~12K+ incremental website visits from Direct channel

- ~12% Increase in Direct Traffic DRR

- ~10% increment in Health Insurance Quotes & ~5% increment in Motor Insurance Quotes

CEO Quotes

Rakesh Jain, CEO, Reliance General Insurance Company Limited commented, “During COVID-19 majority of customer interactions happened digitally and we brought about a series of tech innovations to simplify and make those interactions seamless. However, we as a General Insurance company also understood that Technological disruption needs to amalgamate with humane values and focus on being customer-first, always. That is why we decided to have a brand mascot ‘BroBot’ that embodies this ethos and presents insurance with a fresh perspective to our customers in the new normal”

Comments

Looking For Social Media Tools?

Call Pursho @ 0731-6725516

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads

#Case #Study #Reliance #General #Insurance #Brobot #added #human #touch #digital #services