“Buy now, pay later” allows consumers to purchase goods and pay in installments, similar to a credit card. Why is BNPL gaining popularity? I’ll answer that question and more in this post.

Using BNPL, approved customers can defer payments at checkout — online and in-store. BNPL providers pay the merchant in full, minus a service fee, while the customer pays the provider in agreed-upon installments.

BNPL is also known as “pay-over-time,” “point-of-sale financing,” and “point-of-sale loans.” Providers tend to describe their services slightly differently, even though the basics are more or less the same.

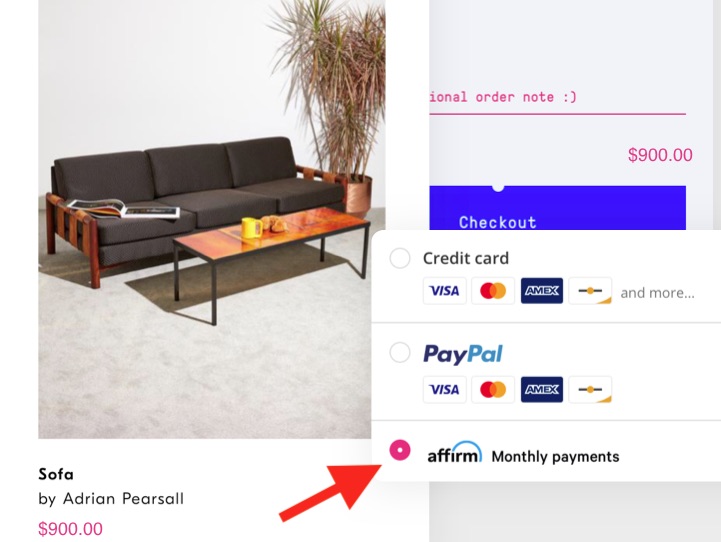

Ecommerce merchants typically display a BNPL payment button alongside the usual credit-card and PayPal logos, and any other payment method. The example below is from Affirm, a leading BNPL provider.

Ecommerce merchants typically display a BNPL payment button alongside the usual credit-card and PayPal logos. Source: Affirm.

When a customer chooses the BNPL option, the provider will conduct a real-time credit check. If the customer is approved, the provider will display to the customer the terms of service — the repayment schedule. From there, customers can check out as usual.

The three types of BNPL services are fixed, flexible, and micro-loans. A fixed offering sets the repayment schedule in advance of the purchase so that the customer knows the number and amount of installments.

A flexible BNPL service allows the customer to select the number of payments — typically three to 36, depending on the value of the purchase and the merchant’s agreement with the provider. The customer’s creditworthiness is also a factor.

Micro-loans, the third type of BNPL, grants a small loan to the customer before completing the checkout. The customer will typically pay a flat fee to the BNPL provider and will agree to a fixed repayment schedule.

Interest, Penalties

Unlike credit cards, many BNPL providers do not charge explicit interest and penalties, including late fees. Some charge interest only for missed payments; others charge a flat fee when payments are late. BNPL providers promote their repayment plans as more transparent and easier to manage than credit card debt.

BNPL providers compete with the issuers of credit cards. Both offer loans and allow buyers to pay for purchases over time. Both earn money by charging fees to merchants and buyers.

However, customers view buy-now-pay-later and credit cards differently. Credit cards have hidden fees, compounding interest, and various penalties. BNPL is more transparent — fees, rates, and payment schedules are usually displayed clearly and explained in simple, customer-friendly terms.

For merchants, accepting BNPL is similar to accepting credit cards. Merchants pay a fee (or lots of fees) to complete a sale.

BNPL Costs

Merchants usually pay a BNPL charge ranging from 2 to 8 percent of the purchase amount. Some providers also charge a flat fee of 30 cents per transaction.

A rate of 2 to 8 percent is higher than a typical credit-card discount rate, which is usually around 2.9 percent plus 30 cents for card-not-present transactions (ecommerce) and about 1 percent less for card-present purchases (in-store).

However, it’s difficult for inquiring merchants to determine the exact BNPL costs because providers rarely disclose pricing without a merchant registering for an account and submitting payment-volume estimates and other info. Merchants should expect to deal with a provider’s sales staff before receiving a quote.

Most providers will deposit funds, minus the fee, in a merchant’s account within two business days. This, again, is similar to credit cards.

Why Accept BNPL?

Why are an ever-increasing number of merchants offering BNPL options if the fees are expensive?

Here’s why.

- Larger purchases, more conversions, reduced cart abandonment. By offering lower monthly payments and more time to pay, merchants can use BNPL to reduce sticker shock and increase conversions. Affirm claims that merchants will experience an 85-percent increase in average order value when customers use its BNPL services. Afterpay, another provider, asserts a 40-percent AOV increase and a 22-percent increase in cart conversions.

- Consumers are shunning credit cards — especially millennials (ages 20 to 40, roughly) and Gen Z (15 to 20). Some shoppers are looking for more transparent ways to manage their finances instead of hard-to-decipher credit cards. BNPL offers payment plans that are simple to understand and potentially easier to pay off.

- Low cost of customer acquisition, particularly during the pandemic. Merchant fees for BNPL transactions (as high as 8 percent) are a small price for many businesses to obtain new customers.

- Holiday shopping in 2020. Shoppers this year will likely seek flexible ways to pay for gifts. BNPL could be the feature that sets your business apart. Move quickly, though. Amazon is already implementing BNPL through a partnership with Citi.

- No chargeback risk. Unlike credit cards, most (but not all) BNPL providers assume fraud and chargeback risks. With the right BNPL partner, merchants don’t have to worry about fraudulent payments.