With Google Chrome planning to block third-party tracking cookies by 2022, the demise of the third-party cookie is looming on the horizon. But new research from Econsultancy’s Future of Marketing Report suggests that few marketers still understand the implications of the crackdown – or have a plan in place for how to do without cookies.

Using the term ‘crackdown’ to refer to the demise of third-party tracking cookies implies a swift and sudden event. But in fact, third-party cookies have been on life support, so to speak, for some time. Mozilla’s Firefox and Apple’s Safari have been gradually ramping up their browsers’ native anti-tracking features over the past several years, to the point where both browsers now block a collective 30% of impressions from third-party tracking cookies. Google Chrome, which accounts for 65% of browser share, announced in January that it would begin doing the same by 2022.

Add to this the fact that multiple bodies, such as the Information Commissioner’s Office (ICO) and European Court of Justice (ECJ), have issued guidance and rulings that invalidate the pretexts many marketers have been relying on to set third-party tracking cookies, and by now you might reasonably expect a large percentage of marketers to be actively preparing for the demise of third-party tracking cookies – if not already phasing out their usage.

And yet in Econsultancy’s survey of more than 800 marketers that informed the Future of Marketing Report, just 36% of marketers stated that they had a good understanding of the third-party cookie crackdown.

Almost half (43%) see themselves as not having a good understanding, while the remaining 21% do not know enough – or do not believe it applies to them.

This is in spite of the fact that close to three fifths (58%) of marketers see the third-party cookie crackdown as “significant” – while 21% say it is very significant.

When it comes to concerns about the impact of the cookie crackdown on specific areas of marketing and advertising, marketers are most concerned about the impact on remarketing, with almost a quarter (24%) saying they are “very concerned” and 31% saying they are “concerned”. Fifty-seven percent are either very concerned (21%) or concerned (36%) about the potential impact on effectively targeting digital display advertising campaigns; a similar percentage (56%) are either concerned or very concerned about the impact on personalising the customer experience.

Finding a better system of measurement

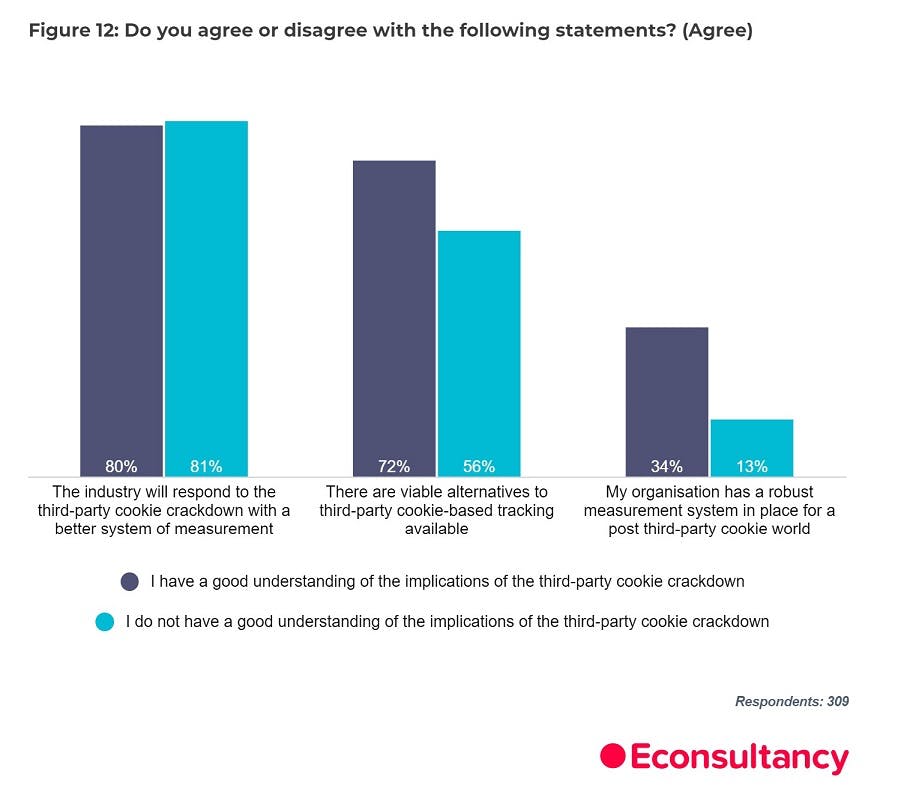

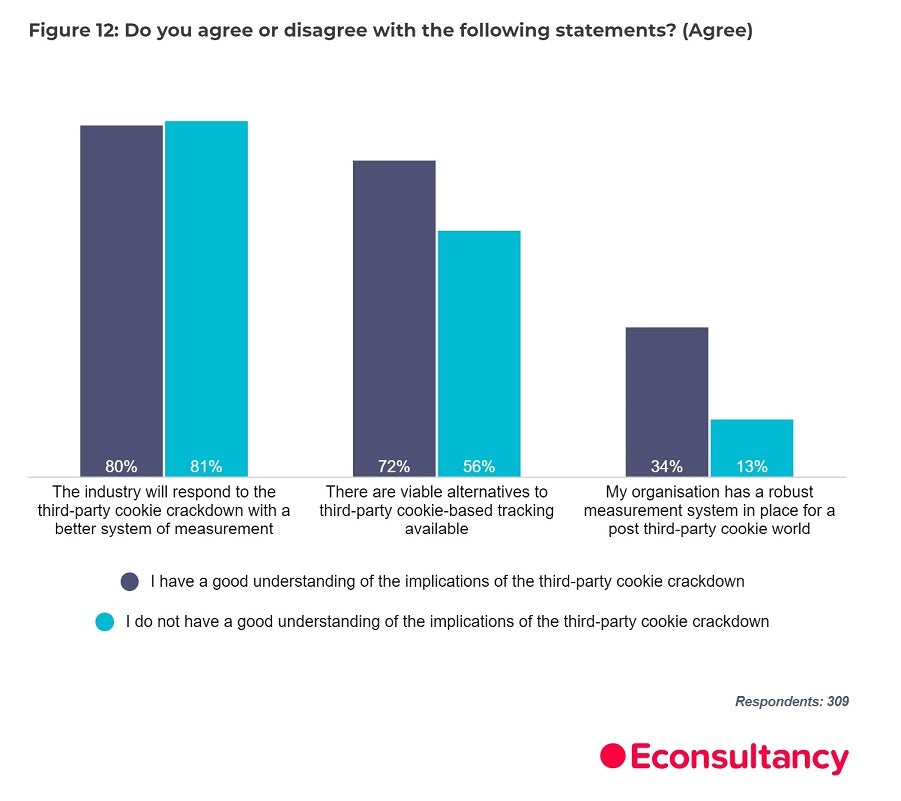

Despite these concerns, the vast majority of marketers are optimistic that a better system of measurement than third-party tracking cookies will be found – regardless of their level of understanding of the crackdown. Among those who have a good understanding of the cookie crackdown, 80% believe that “The industry will respond to the third-party cookie crackdown with a better system of measurement”, while this figure was only marginally higher (81%) among marketers without a good understanding.

This implies that marketers who understand (or think they understand) the extent of what is happening are not necessarily more cynical about the future. In fact, 72% of marketers with a good understanding of the cookie crackdown also say that there are viable alternatives to third-party cookie-based tracking available – compared with 56% of marketers who do not have a good understanding of the crackdown.

And yet few marketers on either side of the equation seem to be prepared for a “post-cookie world”. More than a third of marketers (34%) with a good understanding of the crackdown agreed that “My organisation has a robust measurement system in place for a post third-party cookie world”, compared with just 13% of marketers without a good understanding – but this percentage is not high for either.

What forms of measuring digital marketing effectiveness are marketers looking to in place of third-party cookies? First-party and zero-party data are the favoured methods: more than half of marketers with a good understanding of the crackdown (53%) say their company is considering first-party data as an alternative means of measurement, while just under half (49%) are considering zero-party data.

Digital fingerprinting and second-party data are less favoured, with 20% and 16% of marketers who have a good understanding of the crackdown saying their organisation is considering these methods.

Those marketers without a good understanding of the crackdown are much less likely to say their organisation is considering any alternative methods of measurement, but they also favour first-party data as a potential alternative, with 26% saying that their organisation is considering this form of measurement. Zero-party data and client/device IDs receive equal billing at 15%, while digital fingerprinting (9%) and second-party data (7%) are less favoured.

An opportunity to start again

Though marketers have long regarded the demise of third-party tracking cookies with dread, in addition to being necessary to keep pace with industry regulation and consumer attitudes, phasing out cookies presents a number of opportunities for marketers to improve how they approach data, privacy and measurement.

This was highlighted by multiple expert interviewees for the Future of Marketing Report. Brian Corish, Consultant, Investor for Audientz LLC and former Chief Customer Officer at the Bank of Ireland, proposed using “technology and the digitisation of linear channels as an opportunity to rip up the rulebook and start again. Consumer habits have changed massively and the ability to do targeting and planning measurement, [and] activation has changed completely.”

Glenn Thomas, former CMO of GE Healthcare, added that marketers should be moving away from the “‘Google Analytics’ mindset” and building custom dashboards linked to business outcomes instead. “Specialist marketers can geek out and optimise for their tactic, but ultimately, we need to connect the dots across the customer journey to revenue and loyalty connected metrics.

“Trust, auditability and speed are key so that we can experiment to drive and demonstrate impact.”

However, all of these developments depend on marketers being proactive in familiarising themselves with the third-party cookie crackdown and its potential consequences, researching alternative forms of measurements, and adapting their approach to take advantage of them. And the fact that most marketers still lack, by their own admission, a good understanding of the cookie crackdown at this late stage is concerning to say the least.

While the Covid-19 crisis may have understandably stalled many marketers’ preparations for the demise of third-party cookies, Covid-19 has also demonstrated that a crisis can be an opportunity to start afresh, do away with bad habits and kickstart long-overdue innovation. However, it showed too that companies that lag behind on transformation ultimately suffer the most adverse effects from that crisis.

Marketers should seize the opportunities presented by the cookie crackdown to reinvent their approach to tracking and measurement – before it’s too late to do so.