Computing income tax may seem very complicated unless you are a competent Chartered Accountant. However, a CA might also face troubles at some point. So, to ensure that you have a smooth tax computing process, we will throw some light on the government’s Income Tax Calculator and how to use it.

Spoiler Alert: It is not as hard as you think.

Without any further ado, let’s explore the Government’s Tax Calculator!

Step-by-Step Guide For Using the Government’s Income Tax Calculator

The income tax calculator of the Government of India is available on the Income Tax Department’s official website. Once you open that page, you will have a webpage as shown below.

Let’s understand each of these fields in detail:

1. Assessment Year

The Financial Year (FY) or Previous Year (PY) is a period of 12 months, beginning from April 1 and ending on March 31. It is the year in which income is earned.

Assessment Year (AY) is the year in which the Income Tax Return is filed for the PY. For example, for FY 2018-19, the assessment year would be 2019-20.

2. Tax Payer

All Indian residents are liable to pay tax. They could be individuals, a group of individuals, or an artificial body. You must select from the following categories-

- Individual

- Hindu Undivided Family (HUF)

- Association of People (AOPs)/ Body of Individuals (BOI)

- Domestic Company

- Foreign Company

- Firms

- Limited Liability Partnership (LLP)

- Co-operative Society

3. Male/ Female/ Senior Citizen

You are then required to choose from one of the four options below to determine which tax slabs and rates would be applicable in your case:

- Male (Below 60 years of age)

- Female (Below 60 years of age)

- Senior Citizen (60-80 years of age)

- Super Senior Citizen (Above 80 years)

Here are the applicable tax slabs and rates for each category for FY 2019-20:

| Income Tax Slabs | Tax Rate for Individual & HUF Below the Age Of 60 Years |

|---|---|

| Up to ₹2,50,000* | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% of total income exceeding ₹2,50,000 |

| ₹5,00,001 to ₹10,00,000 | ₹12,500 + 20% of total income exceeding ₹5,00,000 |

| Above ₹10,00,000 | ₹1,12,500 + 30% of total income exceeding ₹10,00,000 |

| Income Tax Slabs | Tax Rate for Senior citizens aged 60 Years but Less than 80 Years |

|---|---|

| Income up to Rs 3,00,000* | No tax |

| Income from Rs 3,00,000 – Rs 5,00,000 | 5% |

| Income from Rs 5,00,000 – 10,00,000 | 20% |

| Income more than Rs 10,00,000 | 30% |

| Income Tax Slabs | Tax Rate for Super Senior Citizens (Aged 80 Years and Above) |

|---|---|

| Income up to Rs 5,00,000* | No tax |

| Income from Rs 5,00,000 – 10,00,000 | 20% |

| Income more than Rs 10,00,000 | 30% |

4. Residential Status

Resident:

To qualify as a resident, a taxpayer would have to fulfill one of the following conditions:

- The taxpayer has stayed in India for a year, i.e., 182 days or more in that year

- The taxpayer has stayed in India in the immediately 4 preceding years for 365 days or more and 60 days or more in the relevant financial year

If an individual leaves India for employment during an FY, only the first condition would apply and not the second.

Not Ordinary Resident:

If an individual has failed to satisfy even one of the below conditions, the individual would be deemed as a “Not Ordinary Resident”, also known as, Resident Not Ordinary Resident (RNOR).

- The individual has been a resident of India in at least 2 out of 10 previous years

- The individual has stayed in India for at least 730 days in 7 immediately preceding years

Non-Resident:

An individual would be a non-resident if he or she fails to fulfill all of the above conditions.

You may also use the Residential Calculator on the Income Tax Department of India’s website to determine your residential status.

5. Income from Salary

This refers to any amount of salary that is due to the employee whether paid or not.

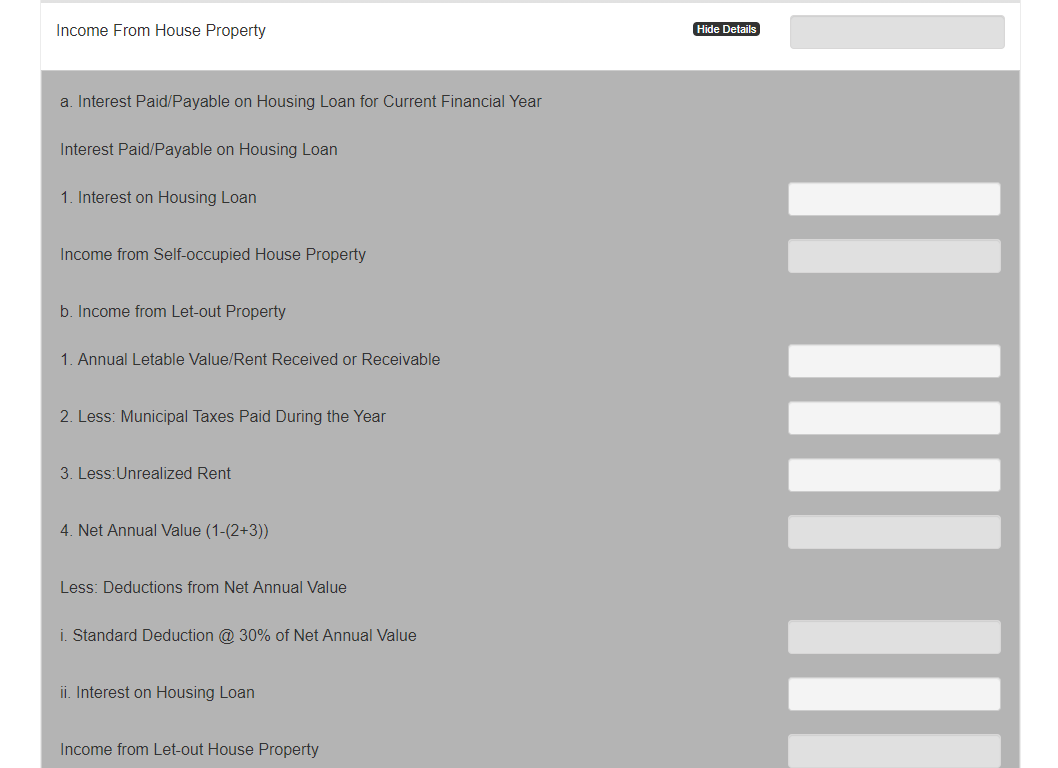

6. Income from House Property

If the assessee owns a property, its annual value is taxable, unless the property is self-occupied. In other cases, the amount of rent received or can be reasonably expected to be received is taxable.

Deductions to the extent of 30% can be claimed on the annual value or the rent received under section 24. Also, interest paid on the loan towards the purchase of the property is allowed as a deduction to the extent of Rs.2,00,000.

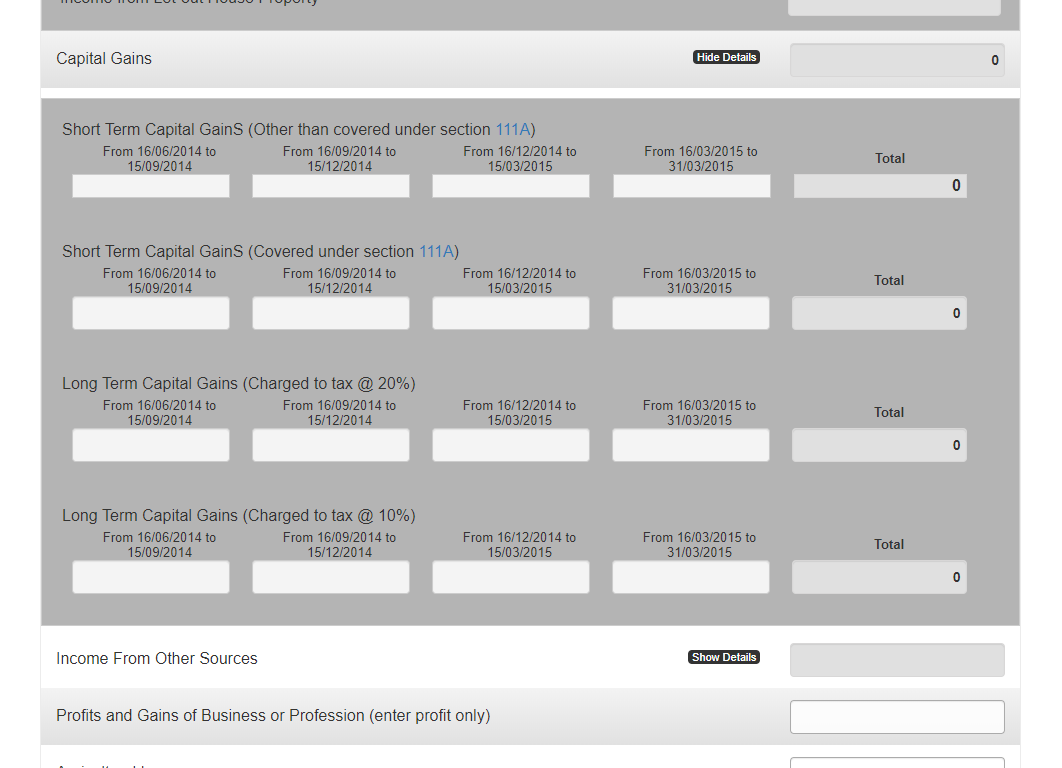

7. Capital Gains

Any profit received from the transfer or sale of a capital asset such as property, securities, jewelry, or a work of art is chargeable to tax. This is further classified as a short term or a long-term capital gain.

If a capital asset has been held for 36 months or less, the profit earned on its sale would qualify as a short-term capital gain. If a capital asset was held for more than 36 months, the profit received from its sale would be a long-term capital gain. However, in the case of capital assets like shares, the holding period of a long-term capital asset is just 12 months.

8. Income from Other Sources

Any income that does not qualify under any of the specific heads of income would be considered as income from other sources. This usually is in the form of interest on fixed deposits or securities, commissions, dividend incomes, family pension, or income from lottery, crossword puzzle winnings, etc.

9. Profit and Gains of Business or Profession

Any profit or gains from a business or profession during the previous year would also be taxable.

10. Agricultural Income

Section 10 of the Income Tax Act does not allow the Central Government to levy any tax on agricultural income. However, the state governments can do so, if the income exceeds Rs.5,000 in a financial year.

The sum of all the incomes mentioned from points 5 to 10, is called your Gross Total Income (GTI).

11. Deductions

You can claim deductions from the GTI based on Chapter VI-A of the Income Tax Act under sections 80C to 80U. Per Section 80A, the amount of these deductions cannot exceed the GTI. While you will find an exhaustive list of deductions under this head, it is the deductions applicable under Section 80C to 80U that are more commonly availed. Let’s see what they are:

Section 80C: This includes LIC and PPF payments, repayment of the principal amount of a housing loan, tuition fees to a school, college or a university, stamp duty or registration fees paid for the transfer of house property, a Fixed Deposit opened for more than five years with a scheduled bank or a post office, investments in Equity Linked Savings Scheme (ELSS) or Mutual Funds with a 3-year lock-in period. The maximum deduction allowable under this section is Rs.1,50,000.

Section 80D: This includes the amount paid towards health insurance policy for self or his/her family. It has been capped at Rs.25,000. However, if the policy is for senior citizens, the limit is raised to Rs.30,000.

Section 80DD: Any expenses incurred towards medical treatment or maintenance of a person with a disability not exceeding Rs.75,000.

Section 80DDB: Any expenditure incurred for medical treatment of specified diseases for self or dependants not exceeding Rs.40,000. This limit is raised to Rs.80,000 in the case of senior citizens.

Section 80G: This includes contributions made towards charitable institutions. It can be claimed up to 100% to certain funds such as the Prime Minister’s National Relief Fund or the National Defense Fund etc. However, for other institutions, it can be claimed up to 50%.

12. Net Taxable Income

When you subtract the above-mentioned deductions from the GTI, you are left with the Net Taxable Income.

13. Income Liable to Tax at Normal Rate

We have already discussed the applicable income tax slabs and rates. However, not all components of the GTI can be taxed at the normal slab rates. There are some components such as the short-term and long-term capital gains and also winnings from the lottery that have specific rates applied to them. Therefore, this head refers to all the income that be taxed normally, also known as “normal income”.

14. Short Term Capital Gains (Covered u/s 111A) 15%

This refers to capital gains earned from the transfer of equity shares held for less than 12 months. Such short-term capital gains would be taxed at a rate of 15%.

15. Long Term Capital Gains (Charged to tax @ 20%) 20%

All long-term capital gains except on sale of equity shares or units of an equity-oriented fund are taxable at the rate of 20%.

16. Long Term Capital Gains (Charged to tax @ 10%) 10%

This refers to long-term capital gains from the sale or transfer of equity shares or units of an equity-oriented fund.

17. Winnings from Lottery, Crossword Puzzles, etc. @ 30%

As the heading suggests, any winnings from the lottery, crossword puzzles, etc. would be taxed at the rate of 30%.

18. Income Tax

This refers to the amount payable as tax at normal rates and also the amount payable as tax at the specific rates, as we saw in the case of capital gains and winnings.

19. Surcharge

An additional percentage in the form of a surcharge is applied to taxpayers with a considerably higher income.

Following are the applicable rates based on the type of taxpayer:

For Individuals, Hindu Undivided Family (HUFs), Body of Individuals (BOI), Association of Persons (AOP) and Artificial Judicial Person (AJP):

| Total Income | Rate of Surcharge applicable |

|---|---|

| Less than Rs. 50 Lakhs | Nil |

| Rs. 50 Lakhs to Rs. 1 Crore | 10% |

| More than Rs. 1 Crore | 15% |

The following surcharge rates are applicable in case domestic companies:

| Total Income | Rate of Surcharge applicable |

|---|---|

| Less than Rs. 1 Crore | Nil |

| Rs. 1 Crore to Rs. 10 Crore | 7% |

| More than Rs. 10 Crore | 12% |

In case of a company that has its control and management situated outside India, or a “Foreign Company”, the following surcharge rates are applicable:

| Total Income | Rate of Surcharge applicable |

|---|---|

| Less than Rs. 1 Crore | Nil |

| Rs. 1 Crore to Rs. 10 Crore | 2% |

| More than Rs. 10 Crore | 5% |

The surcharge rates are lower in the case of foreign companies as they are already taxed at a higher rate than individuals and domestic companies.

20. Health and Education Cess

The income tax and the applicable surcharge is further subjected to a 4% health and education cess. Cess is levied by the government to fulfill certain objectives. In this case, these objectives are related to health and education. The funds collected in the form of cess are solely used to fulfill such objectives.

21. Total Tax Liability

The income tax, the surcharge, and the health and education cess will then determine your total tax liability.

22. Due Date of Submission of Return

To avoid penalties, carry forward losses, and earn relief as applicable, you must file your income tax returns on time. A deadline is set by the government. In this field, you are required to enter that deadline. For example, the deadline to file returns for FY 2018-19 is August 31, 2019. Therefore, for AY 2019-20, you will enter the deadline as August 31, 2019.

23. Actual Date of Submission of Return/Date of Completion of Assessment

Here, you will mention the actual date of submission of the tax return. Based on the due date and the date of submission, any income that has to be set off as a result of losses that are to be carried forward, or any penalties due to late submission will be calculated.

24. Relief

If your total income includes any past dues from the previous years that you may have received in the current year, you may worry about paying a higher tax on arrears, especially when tax rates tend to change over the years and you were in a lower income tax slab when the amount was actually due to you.

Therefore, to protect you from the additional burden of tax, Section 89 allows you a relief. This could apply in case of salary arrears, gratuity, compensation for employment termination, and also family pension.

You can use this calculator on the Income Tax Department of India’s website to determine the amount of relief that you are entitled to under Section 89.

25. TDS/TCS/MAT (AMT) Credit Utilized

Let us first understand what each of these terms means:

- TDS Credit: When certain payments are made towards rent, commission, professional fees, etc. are made, they require the person making the payment to deduct tax at the source and remit the tax amount to the government. This is called TDS. The individual who received the payment less due to TDS can claim the same in the form of a tax credit.

- TCS Credit: This refers to the amount collected by a seller or a company as tax when individuals purchase certain items, such as cars, jewelry, etc. The seller transfers the accumulated amount to the government and issues a TCS certificate against which the buyer can claim the credit.

- MAT Credit: The Minimal Annual Tax is levied on companies that make huge profits, pay dividends to their shareholders but pay no tax by taking advantage of the deductions and exemptions. It is a fixed percentage of their profits that companies have to pay as tax. They can claim credit for such tax paid.

- AMT Credit: While MAT was introduced for companies, Alternative Minimum Tax was introduced in a similar vein for all other taxpayers. Taxpayers can similarly claim credit for AMT too.

Therefore, in this field, you are required to mention the amount of any such credit utilized.

26. Details of Tax Paid

Further to the point above, here you are required to mention the date and amounts of TDS/TCS/MAT/AMT tax payments. You can add more rows in case of multiple payments.

27. Amount of interest u/s 234A

This interest is applicable when you fail in filing your income tax returns on time. If you fail to file your returns before the deadline issued by the Income Tax Department, which is usually July 31 of every following assessment year, as per section 234A, you will be charged an interest of 1% on the outstanding amount each month from the due date till the date when the return has actually been filed.

In this calculator, the amount is auto-computed based on the information entered earlier on in the calculator.

28. Amount of interest u/s 234B

This interest is charged when-

- You make incomplete tax payments

- You delay the payment of advance tax

- If you have paid advance tax, but the amount is 90% less than the assessed value

The rate of interest, in this case, is also 1% per month from the beginning of the assessment year till the date when at least 90% of the advance tax has been paid. In this case, too, the calculator will automatically populate the field based on the details entered in the previous fields.

29. Amount of interest u/s 234C

This interest is imposed when there is a delay in the payment of an advance tax installment. It is applicable when-

- The advance tax paid on or before June 15 is less than 15% of the assessed tax

- The advance tax paid on or before September 15 is less than 45% of the assessed tax

- The advance tax paid on or before December 15 is less than 75% of the assessed tax

- The advance tax paid on or before March 15 is less than 100% of the assessed tax

The interest is calculated at the rate of 1% per month from the cut-off date till the date when the outstanding amount is actually paid.

Wrapping Up

Do give the Income Tax Calculator a go. It’s not as complex as it may seem. There are also a variety of tax tools on the website that can be used for various tax-related purposes.

Editor’s note: This article was originally published in August 2019 and has been updated for comprehensiveness.

Need Any Technology Assistance? Call Pursho @ 0731-6725516