The recency, frequency, and monetary model lets ecommerce marketers identify and market to specific consumer groups based on their transactional behavior.

Ecommerce merchants have many reasons to segment customers and prospects. An example is organizing customers by their interests and then sending relevant, weekly newsletters to those customers.

The recency, frequency, and monetary-value model (RFM) gives merchants the ability to create segments around each customer’s shopping behavior and then assign a three-digit RFM code to each segment.

Recency

The RFM model begins with “recency,” a measurement of when a customer has last purchased from your business.

“The more recently a customer has made a purchase with a company, the more likely he or she will continue to keep the business and brand in mind for subsequent purchases. Compared with customers who have not bought from the business in months or even longer periods, the likelihood of engaging in future transactions with recent customers is arguably higher,” according to Investopedia.

Recency is a relative term, however. If your online store sells consumables such as protein powder, a recent customer has likely purchased in the past month. But Carvana, which sells used cars online or from vending machines (yes, car vending machines), might consider a purchase in the preceding 24 months as recent.

To use the RFM model, establish what “recent” means to your online store. Then divide your store’s customers into five time-based segments. You will end up with ranges that describe when a particular shopper has last made a purchase.

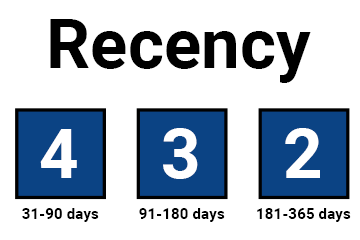

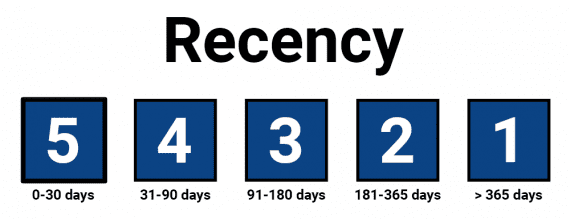

For example, you might create these recency groups:

- 0 to 30 days,

- 31 to 90 days,

- 91 to 180 days,

- 181 to 365 days,

- More than 365 days.

Traditionally, the RFM model has used a 10-point scale. But some ecommerce marketers use five points, which is what I’ve done for this post. In an RFM model, a higher number is typically better. So for a recency scale of 1 to 5, a score of 5 represents the most recent shopper.

- 0 to 30 days | 5

- 31 to 90 days | 4

- 91 to 180 days | 3

- 181 to 365 days | 2

- More than 365 days | 1

In this particular RFM model, a customer who has purchased from your ecommerce business 17 days ago would have a recency score of 5, while a customer who purchased 130 days ago would have a recency score of 3.

In the RFM model, the scores are relative to each business. This hypothetical recency scale, for example, assigns a 5 to customers who have purchased in the preceding 30 days.

Frequency

“Frequency” in the RFM model refers to how often a specific customer purchases from your business. Like recency, frequency is relative to your company.

For example, an online store selling fishing lures might routinely make weekly sales to the same customers. Thus a high-frequency customer might purchase from the store 52 times or more each year. Conversely, a high-frequency customer for a furniture store might buy just twice a year.

In the same way that you created categories for recency, divide frequency into five ranges and associate a score with each one. For example, a commodity product might have the following ranges.

- More than 40 purchases in the preceding year | 5

- 31 to 40 purchases | 4

- 21 to 30 purchases | 3

- 11 to 20 purchases | 2

- 1 to 10 purchases | 1

Using this example, a shopper who purchased 27 times in the preceding year would have a frequency score of 3.

Monetary Value

For the monetary-value category, you might use the lifetime value of a customer, a customer’s average order value, or what a customer has spent in the past year.

You will, again, develop five segments. Here is an example monetary value model for a luxury ecommerce brand.

- Spent more than $40,000 in the preceding year | 5

- Spent $30,001 to $40,000 | 4

- Spent $20,001 to $30,000 | 3

- Spent $10,001 to $20,000 | 2

- Spent $1 to $10,000 | 1

Applying RFM

Using the RFM model, you can divide your customers into segments and associate a three-digit score with each segment.

For example, the 5-5-5 group represents your best customers, since they will have purchased from your store very recently, they buy frequently, and they have a high monetary value. Conversely, the 1-1-1 customer group has not purchased from your business in a long time, does not purchase often, and does not represent a significant monetary value.

Use these segments to set up marketing automation. For example, for a 5-5-5 customer, you might want to automatically notify your CEO, so she can reach out and thank the customer for her business.

Similarly, the 3-5-5 groups might automatically receive an email offer.

Your tactics will depend on your products and industry. Regardless, the RFM model is a powerful tool for marketing segmentation and performance.