Bazaarvoice research combining page views, orders, reviews and surveys reveals high demand for leisure goods during lockdown, not just basic necessities – but also issues with availability.

It’s been nearly eight weeks since the World Health Organization (WHO) declared the Covid-19 outbreak a global pandemic. In this time, the retail space as we know it has had to completely evolve.

Without warning and without choice, brands and retailers have had to adapt to a pandemic that no one saw coming. As a direct result of Covid-19, many non-essential physical stores have been forced to close until further notice. Stores that have remained open have suffered from reduced/rationed stock and social distancing requirements. These actions have resulted in consumers changing their shopping behaviours, which in many cases has resulted in more transactions moving online.

With a network of over 6,200 brand and retailer sites as our client base, Bazaarvoice has unique visibility into current online shopping activity. We have analysed the different patterns and changes in behaviour, from increases and decreases in product page views to orders placed, reviews submitted and questions asked. We’ve reviewed this data globally across more than 20 product categories and compared it to the same time period in 2019, as well as the earlier months in 2020.

How people were shopping in March 2020 – the beginning of the shutdown

During the earliest stages of the lockdown in March 2020, data from the Bazaarvoice Network shows that customers started to really embrace online shopping and began setting themselves up for what looked to be a long period spent at home. We saw a 21% increase in online orders in March 2020 vs March 2019, and in a survey we conducted with over 3,000 members of the Influenster community, 41% of respondents said that they were currently shopping online for things they would normally shop for in-store.

This data highlights what most of us are currently experiencing, as we are having to change our normal shopping habits and look to purchase more items online than we all usually would. When we compared March 2020 vs March 2019, we saw a 25% increase in page views. This is likely due to the increase in time consumers have to search for new products, now that they are mostly housebound, and the fact that they may be purchasing brands they are not familiar with due to limited product availability.

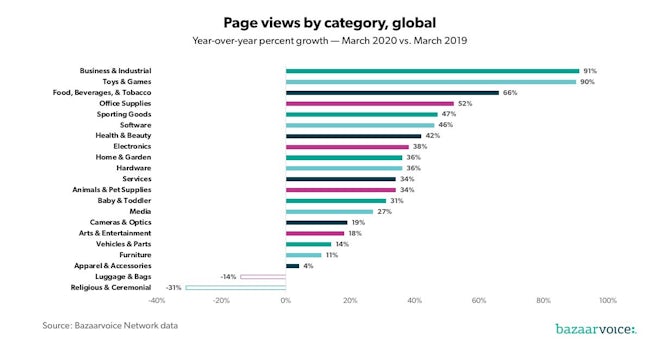

The increase in page views led us to analyse the network data by category to help highlight which products people were browsing, versus which products people were actually purchasing. We saw a year-over-year increase in page views and order count for nearly every product category, but it was the food, beverage and tobacco, toys and games, and sporting goods categories that were in the top five for growth in both page views and order count.

It’s no surprise to see that people prioritised necessities, and also that they looked for ways to entertain themselves and their families.

It’s interesting to note that not all categories have seen the same growth that we mentioned above. Browsing activity is on par with last year for apparel and accessories products, but buying behaviour is down.

This may be due to people not wanting to purchase items in this category until they know when social distancing measures might ease off, yet still wanting to browse the items so they’re up to date with current trends and offers. Luggage and bags have seen a reduction in browsing and buying behaviour, which is expected due to the social distancing measures and restrictions meaning that people aren’t travelling as they were before.

How that differs from online shopping throughout April 2020

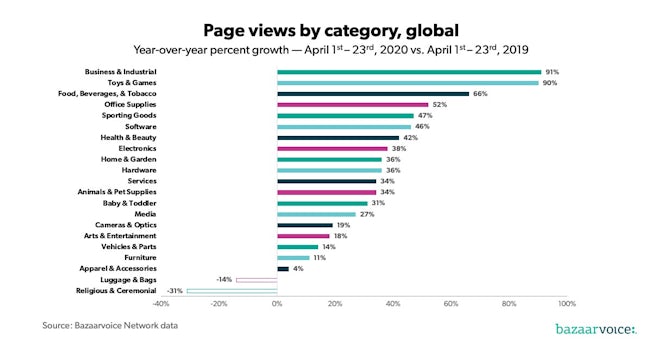

Now to take a look at April 2020. If we compare the data month-on-month, we can see that the stats for April are growing even more rapidly than they were for March. While we can see that page views and order count are trending upwards, with a 75% increase and 95% increase respectively, we wanted to delve into whether the number of reviews shoppers were leaving has also increased.

The data highlights that review count is up, with April growing at 32% year-over-year. As shoppers are increasing the number of items that they purchase, this is likely triggering more post-interaction emails than usual. Question submission – which is where a shopper submits a question around a particular product, such as asking for dimensions or whether they can use it in a specific way – is also seeing positive growth year-over-year, with an increase of 54% in April.

This increase in review and question counts shows that brands, now more than ever, need to engage with their customers. They can do this by answering any questions that they are submitting and also by taking the time to analyse their reviews, to help improve the overall experience for their customers.

Nearing the end of April, we’re seeing toys and games, arts and entertainment, animals and pet supplies, business and industrial, and sporting goods pulling in the largest number of page views. They have pushed the food, beverage and tobacco, and office supplies categories out of the top five.

This is an interesting change in shopper behaviour, as it may highlight that as people get used to spending longer periods of time at home, they are moving past the necessity phase and are now looking to prioritise different categories. This is also true for order count where we see that hardware, sporting goods, vehicles and parts, business and industrial, and arts and entertainment hold the top five spots.

Top priorities for shoppers

Alongside the products that people are viewing and purchasing, consumers’ priorities are also changing as a result of Covid-19. According to our survey, before the pandemic, respondents’ main priorities when purchasing were quality (48%), price (47%) and brand (24%). Now, they’re mostly focused on availability (49%), price (36%) and quality (34%).

It makes sense that availability is such a concern – over half (58%) of respondents said that they have experienced product shortages at stores from which they’ve tried to make a purchase. When asked if they feel like they have access to essential and non-essential supplies, 44% said that they’re getting by, but it’s tricky. Only 30% said that they have been able to get everything they need quite easily.

It’s very interesting to see the change in priority for shoppers, with the focus moving to availability. This will prove a key time for consumers to try new brands that they perhaps wouldn’t have before. This may result in a change in brand loyalty for some consumers who discover new products as part of their new shopping experiences.

Change to shopper circumstances

While we have delved into how people’s shopping behaviour is changing, we are also interested in some of the specific reasons behind why it may be changing, and one of those is changes in our work circumstances. In a recent survey we conducted with over 2,800 members of the Influenster community, we were interested to find out how people’s working situations have changed, as that will have a direct impact on how consumers are shopping and products they are prioritising.

Only 30% said that they have been able to get everything they need quite easily.

Thirty-six percent of respondents are still working their regular hours with their usual salary, while 22% have experienced lay-offs, and a further 8% are anticipating some sort of change based on their company’s current situation. The remaining 34% have experienced either reduced hours, reduced pay, been furloughed or have had to use their paid time off during this time.

As Covid-19 and its impacts continue, we are likely to see further changes to people’s working situations, which may alter shopping behaviour further.

What could this mean for retail?

While it’s key to explore how shopper behaviour is changing throughout this period, the question many people want the answer to is what long lasting impact will Covid-19 have on ecommerce and shopping habits. Which categories will people continue to increase spend in, and which will likely become less of a priority?

The shift we’ve seen in consumers moving to online shopping can only help to accelerate innovation in ecommerce across multiple industries. As companies have been working hard to improve their ecommerce experience – whether that be from improving delivery times, updating product descriptions on web pages, or utilising ratings and reviews across their products – it will be interesting to see whether once Covid-19 is over these consumers keep shopping online, or if they will want to return to shopping in physical stores.

We just don’t know yet. But one thing is for sure: brands that provide a seamless, informative online experience are poised to succeed during this challenging time.

Suzin Wold is SVP of marketing at Bazaarvoice.

![bazaarvoice-2.jpg - purshoLOGY How Covid-19 has changed shopper behaviour [stats] – Econsultancy](https://www.purshology.com/wp-content/uploads/2020/05/bazaarvoice-2.jpg)