Businesses have expenses to pay. “Paying the bills” might not seem interesting or new, but recent innovations make disbursements faster, cheaper, safer, and more convenient.

The innovations would likely help your company if it relies on (or suffers from) any of the following.

- You issue paper checks to pay employees, subcontractors, partners, or suppliers.

- Bank-to-bank payments and transfers take a long time, which results in reduced customer and partner satisfaction.

- Partners and suppliers demand faster payments.

- You have been the victim of check fraud, or you incur additional expenses in resending paper checks.

- Fees for domestic and international bank transfers have increased.

- Your bookkeeping, settlement, and reconciliation processes are complicated and time-consuming.

- Customers, subcontractors, and employees use online banking.

- Your business involves reimbursements or payouts, such as cash-back loyalty programs or insurance remittances.

Use Cases

Marketplaces and affiliates. Running an ecommerce marketplace or an affiliate program means that you, as the owner, will pay commissions and fees (or deduct commissions and fees) from the proceeds of a sale. Traditionally, sellers and affiliates received funds by check, bank transfers, or sometimes via PayPal. And the process of calculating, settling, and reconciling payments can be confusing.

No longer. Providers of new disbursement technologies allow the affiliate manager or marketplace operator to pay in near real-time without any additional banking or payment procedures.

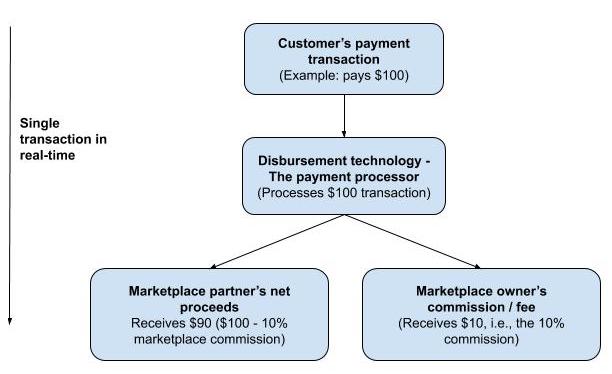

When a sale is completed, the technology deducts commissions and immediately sends the proceeds directly to the partner. There’s no extra accounting or check-writing.

Innovations in payment technologies allow affiliate managers and marketplace operators to pay seamlessly in near real-time, such as this example of a $100 transaction.

Subcontractors such as delivery drivers and temporary employees are traditionally paid by check or bank transfer. There are now more options. Many suppliers will accept (or prefer) non-bank methods. The supplier gets paid faster, and the merchant avoids hefty transfer fees.

Visa Direct, for example, allows businesses to push funds directly to a subcontractor’s Visa account — avoiding checks and bank transfers. And disbursements via PayPal are common for offshore subcontractors such as programmers and writers.

Employees. Modern disbursement technology allows businesses to pay employees in ways that avoid checks or bank transfers. Employees can receive their funds quickly and safely.

Payouts. A business that provides payouts (insurance companies, for example) can use modern disbursement technology to distribute funds to their customers quickly with increased convenience for everyone. Instead of waiting for a check, customers can receive funds directly to a Visa or PayPal account.

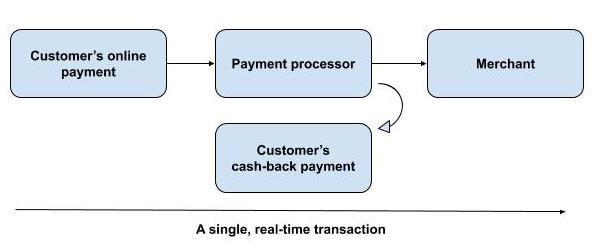

Cash-back, rebates, and loyalty programs. Some of the new technologies can help with cash-back loyalty programs as payments appear in customers’ accounts quickly, without any additional effort, which, ironically, increases loyalty.

New technologies can streamline cash-back loyalty programs as payments appear in customers’ accounts quickly, without additional effort.

Providers

By way of examples, here are three providers at the forefront of payments innovation.

Visa Direct is available to payment processors who can then offer it to merchants. With Visa Direct, merchants can push funds to Visa credit and debit accounts, such as to contractors. Merchants pay a small fee for the service, but it is generally less than the cost of writing and managing paper checks.

PayPal’s MassPay API facilitates the calculating, automating, and scheduling of disbursements to a list of recipients. Fees apply, as always, but the cost of traditional bank-to-bank payments and transfers are generally much higher.

Stripe Connect, another API, is useful for splitting the proceeds of a single transaction among multiple recipients. You’ll likely need an experienced developer to implement. But once it’s running, Stripe Connect is an effective way to distribute commissions and fees to, for example, multiple marketplace participants.