Offering multiple forms of payment, especially for mobile shoppers, will be key in 2020. Smartphones play a role in most online purchases, and the payment methods your store accepts can make or break a sale.

There are five main types of payments for ecommerce sites, including mobile. Merchants should offer all of them.

5 Types of Payments

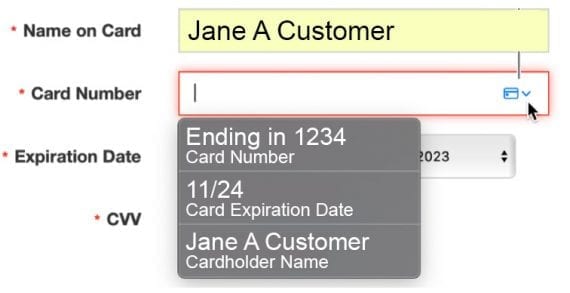

Credit cards. Standard credit card payments require shoppers to enter full card numbers, expiration dates, and CVV codes. Basic credit card processing has been the standard for decades, but it comes with hassles in the mobile world. Sites that don’t allow for autofill frustrate customers and results in about 25 percent fewer online form submissions, according to a Google Chrome study.

Autofill lets shoppers quickly complete forms and payment fields with data they store on their local devices.

Disabling autofill functionality on checkout pages reduces conversions for a couple of reasons:

- Requires access to a physical card, typically. Since many mobile orders are placed while someone is on-the-go, taking out a physical wallet isn’t always feasible. Not everyone has her card numbers memorized. Fewer have the expiration date or CVV at the front of their minds.

- Requires manual entry of payment info, which takes time and produces typos. Many shoppers abandon purchases to avoid having to re-enter payment data.

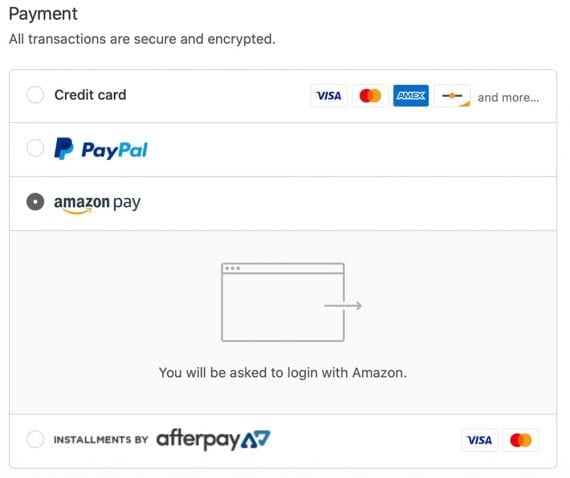

Integrated express checkouts such as Amazon Pay and PayPal allow shoppers to seamlessly pay. Processing rates are typically similar or slightly higher than credit cards, but these speedy options can help seal the deal on big purchases. Express checkouts reduce the amount of data that needs to be entered (most pass the shipping address and contact information to the shopping cart) and allow shoppers who are less trusting of ecommerce sites to pay with confidence securely.

Amazon Pay allows shoppers to pay via their Amazon account. The service autofills the shipping address and contact info to the shopping cart.

Mobile payment wallets such as Apple Pay, Google Pay, and many more require little more than a passcode, thumbprint, or face scan. Much like the way mobile-savvy users pay for things at vending machines, coffee shops, and specialty stores, these wallets can be used for ecommerce.

Social-based mobile payments, such as Messenger, are preferred by younger shoppers. Such payments can also prompt dialog with friends and family. For example, Venmo users can opt to share info about purchases with friends, sparking conversation about a brand and its products.

Venmo’s social-based payments can also serve as a marketing tool.

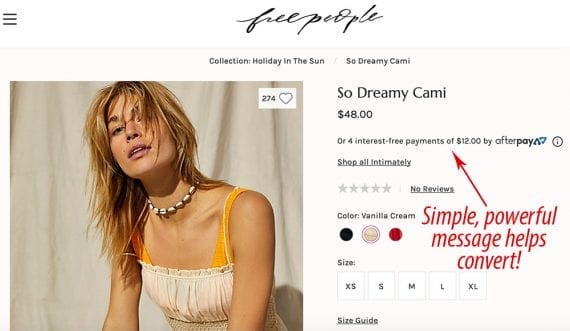

Pay later methods are the better alternative to layaway, which most online stores don’t offer, anyway. Services such as PayPal Credit (formerly Bill Me Later) and Afterpay allow consumers to get products now and pay for them later in installments. Merchants pay a fee to accept these types of transactions, but funds are deposited when the order is placed. While some pay-later services allow for order totals as low as $35, studies show that average order values for these types of payments are about 18 percent higher.

The idea of paying in installments became popular when television shopping networks such as QVC introduced them. Consumers across all age groups use them because they make it more affordable. Opt for a service that is interest-free (to the buyer) to close the most sales.

Pay later methods, such as this one from apparel retailer Free People, are embraced by all types of shoppers.

Careful Presentation

You might think that having multiple payment options causes confusion with shoppers. But it boils down to presentation. Group methods by the type of payment to help.