ByteDance, the company behind the wildly popular short video app TikTok, is a rapidly rising star in the Chinese tech scene.

Last year, after a $3 billion investment round, ByteDance claimed the title of ‘the world’s most valuable start-up’.

Then, just a few days ago, the news broke that ByteDance is now the second-biggest player in the Chinese digital advertising landscape, taking 23% of all digital media spend in the first half of 2019 – equivalent to 50 billion yuan (or $7 billion). In the process, ByteDance leapfrogged over some of China’s most important tech companies, including the (slightly ailing) search giant Baidu, and Tencent, the owner of omnipresent super-app WeChat.

Ad revenue for ByteDance grew 113% in the first half of this year, according to a report by consultancy R3, who described ByteDance’s growth as “extraordinary”. Most of the growth in ad revenue came from Douyin, the Chinese equivalent of TikTok, and Jinri Toutiao, ByteDance’s news aggregator app.

ByteDance’s rise has been nothing short of meteoric, achieving an estimated value of $78 billion in just six years. The company boasts some of the most popular apps in China, and this year set out to take on the dominance of WeChat with its own chat app that allows users to send disappearing videos. Plus, its short video platform TikTok has taken the west by storm.

But plenty of companies behind popular apps and social networks falter when it comes to turning a profit. So, how has ByteDance succeeded in becoming one of the biggest players in Chinese advertising?

Cutting-edge recommendation algorithms

So much of the success of ByteDance’s apps hinges on the sophisticated recommendation algorithms that ByteDance has developed that present users with a stream of content perfectly tailored to their interests.

According to a former ByteDance employee interviewed by the Wall Street Journal, ByteDance’s news aggregator app Jinri Toutiao builds up a sophisticated profile of its users over time, sometimes containing as many as 2,000 tags, to drive recommendations. The app can respond to behaviours as subtle as swiping back up to re-read a paragraph, and will add keywords from that paragraph to the user’s recommendation profile.

Zhang Yiming, founder and CEO of ByteDance, has compared this approach of delivering users exactly the content they want without them needing to lift a finger favourably to other services like Google Reader, which Google killed off in 2013. In an essay published on social media, he claimed that Google Reader’s approach of requiring users to identify their own interests in order to receive relevant content was user-unfriendly, because people were “forced to figure out ‘what I like and what I want’ themselves” instead of having algorithms tell them.

ByteDance’s content recommendation algorithms are so effective as to be dangerously addictive: Douyin, the Chinese counterpart to TikTok, was forced to add a warning that pops up after users spend 90 consecutive minutes viewing videos; after two hours, the app will lock itself and require a password to unlock.

These powerful recommendation algorithms may also be the secret to ByteDance’s advertising success. According to a report by Hua Chuang Securities released in October and quoted by the Financial Times, companies will increasingly come to rely on the efficiency of their recommendation algorithms in advertising – and “the high rate of accuracy of ByteDance’s algorithms … will make it gradually become the market leader.”

Search giant Baidu once had the edge in this area thanks to an immense amount of search data that allowed it to accurately target ads to users. But web search in China is now on the decline as users increasingly spend all their time within “walled garden” apps like WeChat, Douyin and Jinri Toutiao that can’t be indexed by search engines.

In other words, automated recommendations are the new search intent – and ByteDance, which has spent seven years refining its recommendation algorithms, is perfectly placed to capitalise on this change. David Dai, a Senior Analyst at Bernstein Research, told the FT that, “What is truly cutting-edge today in China is recommendation ad technology. In this, China might be ahead of the rest of the world — and by China I mean ByteDance.”

An engaged, highly valuable audience

The other secret of ByteDance’s advertising success is the highly desirable audience it has managed to cultivate on its platforms. Apps like Douyin and Jinri Toutiao appeal to a young, well-off demographic: according to Uplab Asia’s Douyin Playbook, in the early days the vast majority of the app’s user base was female, aged between 18 and 24 years old, from “first tier” Chinese cities – big metropolitan hubs like Beijing and Shanghai.

Nowadays, the app’s userbase has diversified, but roughly three-quarters of its users are still under 35 years old, and close to 30% are under 24. Thirty-five percent of Douyin’s users are located in China’s wealthiest first tier cities, with a growing influx of users coming from slightly less wealthy – but still significant – second-tier cities like Zhongshan and Shaoxing.

Two charts illustrating the demographics of Douyin users. The left-hand chart shows the gender split between female (orange) and male (blue) while the right-hand chart shows the age distribution of Douyin’s userbase.

Similarly, more than 85% of Jinri Toutiao users are millennials living in China’s first- and second-tier cities, according to Dragon Social, and more than two fifths (41.3%) have obtained a bachelor degree or above. These educated, urban and tech-savvy users have a high purchasing power, making them a major attraction for the businesses who advertise with ByteDance.

As previously mentioned, these users are also highly engaged with the apps they spend time on: Douyin users are reported to spend an average of 52 minutes per day browsing the app, while Jinri Toutiao users average a remarkable 73 minutes per day, consuming a cumulative 1.3 billion articles on the app. It’s impossible to overstate the appeal of this kind of captive audience to advertisers.

Where to from here?

ByteDance is clearly moving to capitalise on this early advertising success and establish itself as a major long-term player in the Chinese ad market. In 2018, it launched its own advertising network, Pangolin, to compete with similar ad networks owned by Baidu and Tencent. According to its website, Pangolin currently boasts more than 85,000 advertisers across 117 segmented verticals, with a focus on gaming, entertainment and ecommerce.

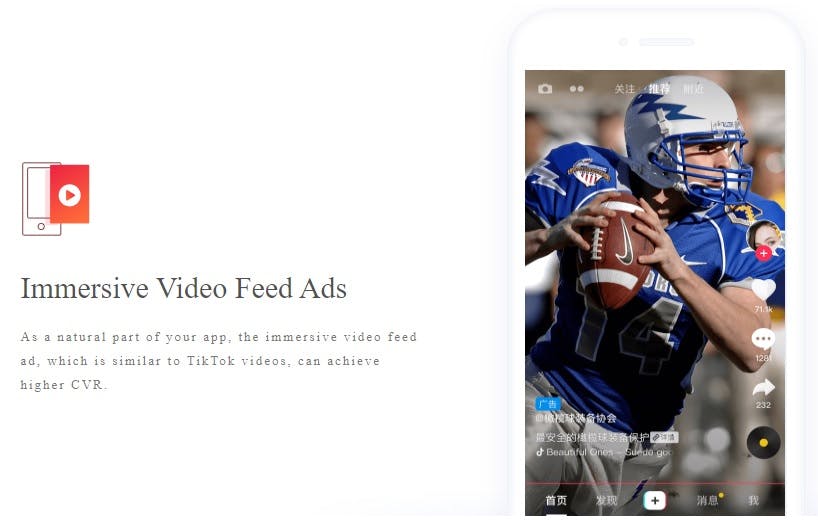

A look at the website shows that ByteDance is playing to its strengths: it claims to combine data from “billions of daily active users” with “top AI recommendations technology” to deliver the best results possible for advertisers. The ad formats it offers include in-feed native ads, full-page interstitial video ads, and immersive video feed ads, which are advertised as being “similar to TikTok videos” and reportedly command a higher conversion rate.

According to KrAsia, ByteDance is expecting Pangolin to contribute between 10 and 20% of its total revenue, which would translate to between five and 10 billion yuan (between US $700 million and $1.4 billion, roughly speaking) per year. Baidu’s own ad network pulls in 8.5 to 10 billion yuan, while Tencent’s reportedly earns around nine million yuan.

Clearly, ByteDance has set its sights high, and so far the evidence suggests that it will be able to live up to its lofty ambitions.