Choosing to start a business is a major life choice. For months and even years, many entrepreneurs are required to severely budget their daily lives so that they can afford to fuel their businesses on the road to startup success. The riskiest part is, the majority of them never get to their destination. According to the SBA, 30% of new businesses fail within the first two years of launch, and 50% of them fail within the first five years.

Without seed funding, whether in the form of equity or debt, many entrepreneurs burn out of cash before having the chance to reach profitability. On average, it takes startups three years to raise seed funding – and that can seem like an eternity when you are self-funding.

Who Funds Startups?

Luckily, there are many ways to fund a startup. Depending on what type of funding you seek, there are pros and cons, and different levels of difficulty associated with securing it. The most popular sources of startup funding include:

-

Personal Loan: Unbeknowst to many new entrepreneurs, banks typically don’t fund new business ideas. They do, however, fund personal loans to credit-worthy individuals which can be used for business purposes. Some entrepreneurs have used home equity loans or even retirement funds to launch their businesses. While this is the easiest way to raise funding for a startup (assuming you meet the bank’s requirements), it is also the riskiest since the repayment will be owed whether the business succeeds or fails.

-

Friends & Family: Founders often rely on their peers to invest in their dreams. As the first investors, friends and family have the opportunity to take early ownership in the company and reap the benefits of the startup’s success. However, if the business does not work out, these investors may lose their investment; which can have negative effects on the founder’s personal relationships.

-

Angel Investors: Angels are wealthy individuals that invest in businesses – both startups and existing businesses alike. Before investing in a startup, angels expect to see some level of progress – proof that the founder has maximized the resources that they had available to them before searching for more. Angel investors are much harder to impress than family and friends, but they can offer many benefits including business experience, wide networks, and access to further capital.

-

Venture Capitalists: VC firms typically have funds with capital invested from many different investors. These firms are extremely difficult to strike an investment deal with, as they expect to see significant traction and they often only invest in the most promising startups. However, these deals are usually the largest, since these firms often have investment minimums of $500,000 or $1 million.

How Much Can A Startup Raise?

The amount a startup can raise is based upon their startup valuation. Startups that have validated their idea with a real product, secured real customers, and generated revenue are able to raise more seed money than those that are still in the ideation stage.

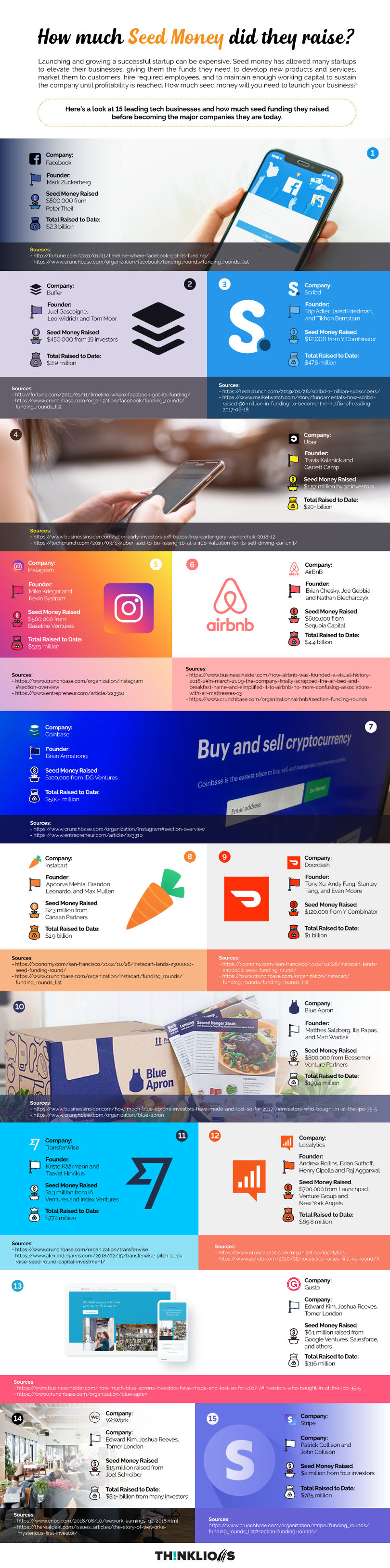

Check out the following infographic from ThinkLions to see how much seed money was raised by some of today’s most successful startups.